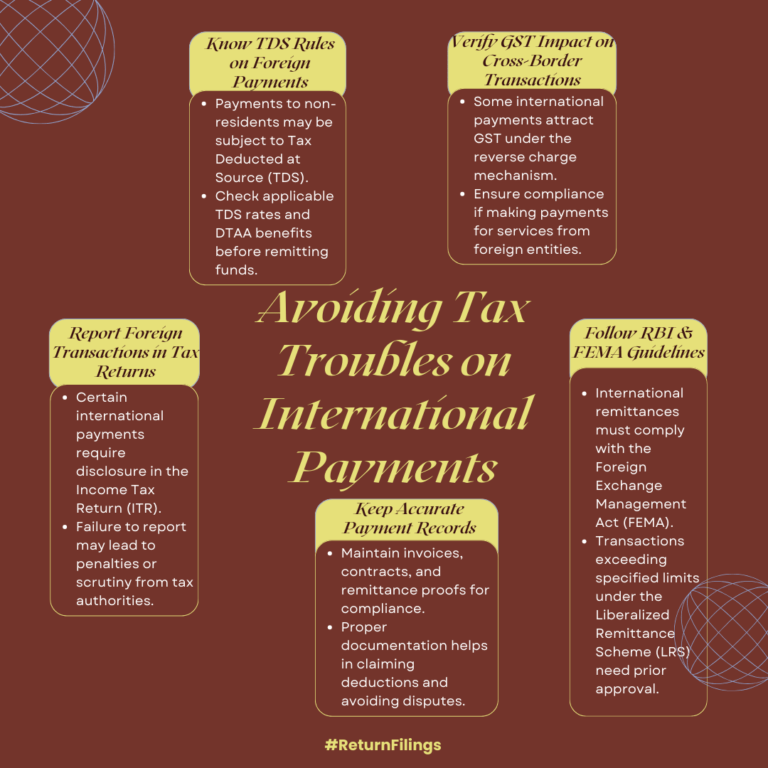

Know TDS and GST rules, follow FEMA guidelines, and report all foreign payments in ITR to avoid tax disputes.

This infographic highlights steps to avoid tax troubles on international payments. Deduct TDS as per DTAA, check GST under reverse charge, and comply with FEMA and RBI’s LRS limits. Report all relevant payments in your ITR and keep accurate records of invoices and remittances. Proper documentation and compliance help claim deductions and avoid disputes or penalties.