Addition / Removal of Partner in LLP

Addition / removal of partner in LLP can be done after alteration in LLP Agreement and after consent of all existing partners. Further any change shall also need to adhere to the provisions of LLP Act 2008.

Start With Confidence

CA/CS Assisted | 4.8/5 Rating

CA/CS Assisted | 4.8/5 Rating

LLP being a registered entity is governed and regulated by the Limited Liability Partnership Act 2008. Every LLP formed must contain minimum of 2 partners for effectively and smooth functioning of the LLP. Any addition / removal of partner in LLP need to adhere to LLP Act 2008.

Apart from the LLP Act 2008, a LLP is also regulated by the by-laws as contained in the LLP Agreement filed at the time of incorporation of the LLP as amended from time-to-time as on date.

LLP Agreement contains clauses relating to admission of new partner and resignation or removal of any existing partner. Any Addition / removal of partner in LLP need to change in LLP Agreement.

Any individual can become partner in any existing LLP by giving an expression of interest of its intention to becoming a partner in LLP, thereafter considering the by-laws of the LLP as per LLP Agreement the existing partners may decide for addition of partner in a properly convened meeting of existing partners.

Before admission of any partner, final account of the LLP must be prepared clearly showing profit and loss account before the admission of partners and the existing partners capital balance before the admission of any partner must also be calculated and arrived.

Any individual can resign from the partnership of existing LLP, before resigning it must be ensure that after resign of any partner the number of remaining partners must not fall below 2. The resignation must be properly send to remaining partners on the registered address of the LLP. The resignation must be in 30 days advance or such number of days as enumerated in the Partnership agreement.

Before resignation of any partner, final account of the LLP must be prepared clearly showing profit and loss account before the resignation of partners and the existing partners capital balance before the resignation of any partner must also be calculated and arrived. The share of resigned partner must be provided to him as per the terms of Partnership deed in accordance with financial statement drawn.

Any Addition / removal of Partner in LLP need to be intimated to Registrar through e-filing of required forms available on the portal of MCA. Any change made shall be reflected in the LLP Master data available for public information on the portal of MCA.

For the purpose of effecting the change in partners either addition of new partner of resignation / removal of existing partner or with both, this must also be intimated to the Registrar through properly e-filing of required LLP forms on the MCA Portal.

Following e-forms are required to be filed within 30 days of effecting the change in LLP, every change in LLP must be in accordance with LLP agreement and newly formed supplementary LLP Agreement which becomes part of original LLP agreement.

Form LLP-3 is required to be filed for intimation with regard to change in limited liability partnership agreement and Form LLP-4 is required to be filed for intimation regarding addition or deletion in partners.

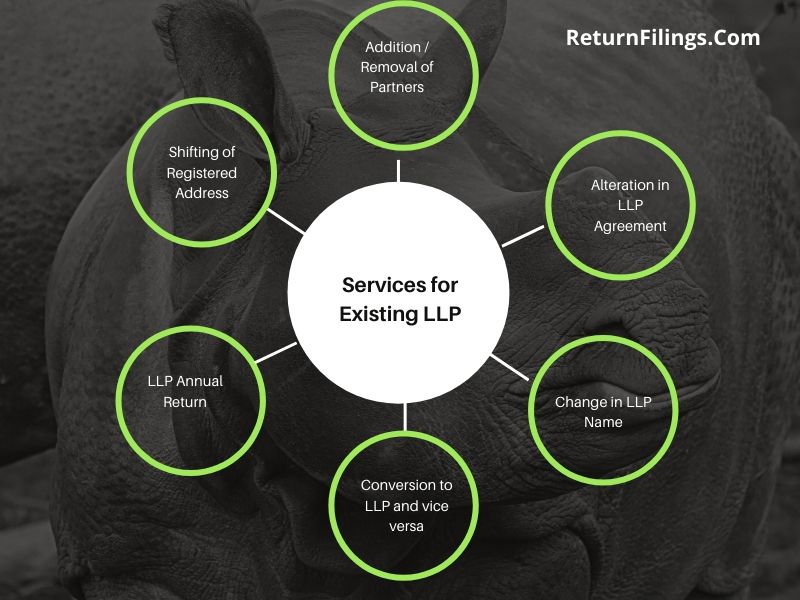

With the ever changing Law and regulatory requirements, we keep on track and advise the same on timely manner in order to ensure proper compliance. We at ReturnFilings.Com will understand the purpose of your addition / removal of partner in LLP and thereafter will provide you detailed analysis mentioning the law requirement and compliances need to fulfil in order to provide addition / removal of partner in LLP related services economically and efficiently. We at ReturnFilings.Com will provide you details of regulatory filings in order to ensure proper smooth and timely compliances. We at ReturnFilings.Com are determinate to provide end to end solution; our motto is you concentrate on your business while we at ReturnFilings.Com will take care of all your compliances need relating to addition / removal of partner in LLP.

LLP being a registered entity is governed and regulated by the Limited Liability Partnership Act 2008. Every LLP formed must contain minimum of 2 partners for effectively and smooth functioning of the LLP. Any addition / removal of partner in LLP need to adhere to LLP Act 2008.

Apart from the LLP Act 2008, a LLP is also regulated by the by-laws as contained in the LLP Agreement filed at the time of incorporation of the LLP as amended from time-to-time as on date.

LLP Agreement contains clauses relating to admission of new partner and resignation or removal of any existing partner. Any Addition / removal of partner in LLP need to change in LLP Agreement.

Any individual can become partner in any existing LLP by giving an expression of interest of its intention to becoming a partner in LLP, thereafter considering the by-laws of the LLP as per LLP Agreement the existing partners may decide for addition of partner in a properly convened meeting of existing partners.

Before admission of any partner, final account of the LLP must be prepared clearly showing profit and loss account before the admission of partners and the existing partners capital balance before the admission of any partner must also be calculated and arrived.

Any individual can resign from the partnership of existing LLP, before resigning it must be ensure that after resign of any partner the number of remaining partners must not fall below 2. The resignation must be properly send to remaining partners on the registered address of the LLP. The resignation must be in 30 days advance or such number of days as enumerated in the Partnership agreement.

Before resignation of any partner, final account of the LLP must be prepared clearly showing profit and loss account before the resignation of partners and the existing partners capital balance before the resignation of any partner must also be calculated and arrived. The share of resigned partner must be provided to him as per the terms of Partnership deed in accordance with financial statement drawn.

Any Addition / removal of Partner in LLP need to be intimated to Registrar through e-filing of required forms available on the portal of MCA. Any change made shall be reflected in the LLP Master data available for public information on the portal of MCA.

For the purpose of effecting the change in partners either addition of new partner of resignation / removal of existing partner or with both, this must also be intimated to the Registrar through properly e-filing of required LLP forms on the MCA Portal.

Following e-forms are required to be filed within 30 days of effecting the change in LLP, every change in LLP must be in accordance with LLP agreement and newly formed supplementary LLP Agreement which becomes part of original LLP agreement.

Form LLP-3 is required to be filed for intimation with regard to change in limited liability partnership agreement and Form LLP-4 is required to be filed for intimation regarding addition or deletion in partners.

With the ever changing Law and regulatory requirements, we keep on track and advise the same on timely manner in order to ensure proper compliance. We at ReturnFilings.Com will understand the purpose of your addition / removal of partner in LLP and thereafter will provide you detailed analysis mentioning the law requirement and compliances need to fulfil in order to provide addition / removal of partner in LLP related services economically and efficiently. We at ReturnFilings.Com will provide you details of regulatory filings in order to ensure proper smooth and timely compliances. We at ReturnFilings.Com are determinate to provide end to end solution; our motto is you concentrate on your business while we at ReturnFilings.Com will take care of all your compliances need relating to addition / removal of partner in LLP.