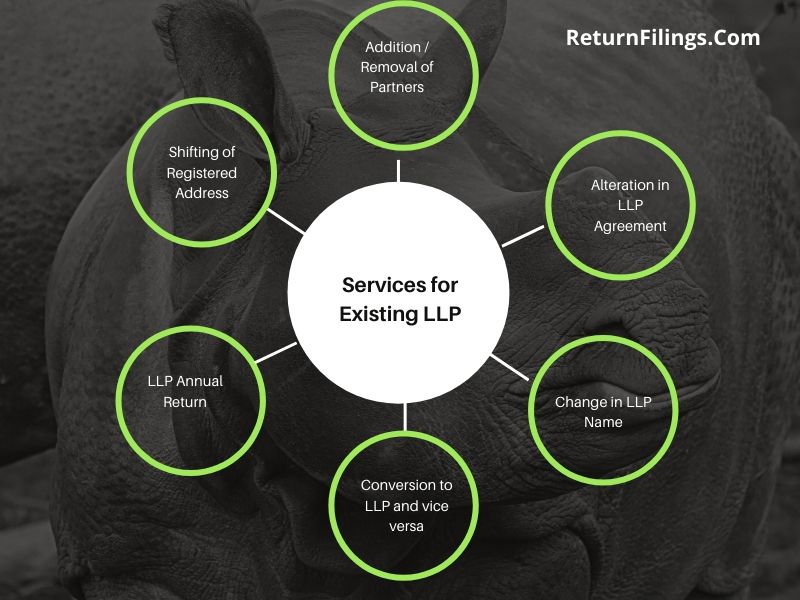

Change in LLP Agreement

Change in LLP Agreement can be made at any time as per the requirement and need arises for such change. All such change need to be made in Supplementary LLP Agreement forming part of main LLP Agreement.

Start With Confidence

CA/CS Assisted | 4.8/5 Rating

CA/CS Assisted | 4.8/5 Rating

Every LLP incorporated in India is regulated and governed by The Limited Liability Partnership Act 2008 read with The Limited Liability Partnership Rules 2009 and with the bye-laws of the LLP contained in The Limited Liability Partnership Deed.

Limited Liability partnership Deed is a written agreement between the existing partners of the LLP properly executed on the requisite value of Stamp paper calculated on the basis of capital of the LLP. This Limited Liability partnership deed is termed as LLP Agreement.

As per the requirement and in accordance with the need of ever changing business scenarios, the LLP once incorporated need to change and adapt itself as per the circumstances. Any circumstances which warrant change in LLP agreement must be made with the supplementary agreement. A supplementary agreement must also be made sequentially as per their execution such as supplementary agreement 1, supplementary agreement 2, and supplementary agreement 3 and so on.

Supplementary Agreement is made and executed for every change in LLP agreement. Some of the common examples of executing a supplementary agreement are:

Every LLP incorporated in India is regulated and governed by The Limited Liability Partnership Act 2008 read with The Limited Liability Partnership Rules 2009 and with the bye-laws of the LLP contained in The Limited Liability Partnership Deed.

Limited Liability partnership Deed is a written agreement between the existing partners of the LLP properly executed on the requisite value of Stamp paper calculated on the basis of capital of the LLP. This Limited Liability partnership deed is termed as LLP Agreement.

As per the requirement and in accordance with the need of ever changing business scenarios, the LLP once incorporated need to change and adapt itself as per the circumstances. Any circumstances which warrant change in LLP agreement must be made with the supplementary agreement. A supplementary agreement must also be made sequentially as per their execution such as supplementary agreement 1, supplementary agreement 2, and supplementary agreement 3 and so on.

Supplementary Agreement is made and executed for every change in LLP agreement. Some of the common examples of executing a supplementary agreement are:

- Addition of any new partner

- Removal or resignation of any existing partner

- Change in Capital or profit sharing ratio

- Change in business activity of the LLP

- Change in management composition of the LLP

- Alteration in rights and liability of any partner

- Alteration or change in any other clause of the LLP