Director Identification Number (DIN) in India: Application, Compliance & Updates

1. Introduction to DIN

Director Identification Number (DIN) is a unique eight-digit identification number allotted by the Registrar of Companies (ROC) to individuals who intend to become directors in any company or Limited Liability Partnership (LLP). DIN remains with the individual throughout their lifetime unless surrendered or deactivated due to non-compliance.

2. Importance of DIN

DIN serves as a crucial requirement for individuals holding directorships in companies and partnerships in LLPs. It ensures transparency, accountability, and regulatory compliance. Even if a director or partner resigns, their DIN remains valid unless voluntarily surrendered.

3. Key Features of DIN

• Unique identification number issued by the Ministry of Corporate Affairs (MCA).

• Essential for company incorporation and appointment as a director.

• Remains unchanged even if the individual moves to different companies or LLPs.

• Requires periodic updates for any changes in personal details.

4. Obtaining a DIN

4.1. For New Directors or Partners

Individuals intending to become directors or partners must obtain a DIN before appointment. The process differs for:

• Existing Companies or LLPs: Application via Form DIR-3.

• New Company or LLP Incorporation: DIN is generated at the time of incorporation through the SPICe+ (Simplified Proforma for Incorporating Company Electronically) form.

4.2. Documents Required for DIN Application

• PAN card (for Indian nationals)

• Passport (for foreign nationals)

• Aadhaar card

• Address proof (electricity bill, bank statement, etc.)

• Passport-size photograph

• Declaration in Form DIR-3

5. Compliance Requirements for DIN Holders

5.1. Annual DIR-KYC Compliance

All individuals with an active DIN must complete the annual DIR-KYC compliance to maintain their active status. The verification is done via:

• Form DIR-3 KYC: For first-time KYC or updates.

• DIR-eKYC Web-based verification: Available if there are no changes in personal details.

• OTP verification on registered email and mobile number.

5.2. Consequences of Non-Compliance

Failure to comply with DIR-KYC results in deactivation of DIN and attracts a penalty of INR 5,000 for restoration.

6. Updating DIN Details

If there are changes in the director’s details, the following updates must be made using Form DIR-6:

• Change in name

• Change in father’s name

• Change in PAN or Aadhaar

• Change in address or contact details

7. Surrendering or Restoring a DIN

7.1. Surrendering DIN

DIN can be surrendered using Form DIR-5 if:

• The individual has never been appointed as a director in any company or LLP.

• The DIN was obtained in duplicate.

7.2. Restoring an Inactive DIN

The MCA may deactivate a DIN due to non-compliance or regulatory action. Restoration is done by filing an appeal with the National Company Law Tribunal (NCLT) and complying with the necessary conditions.

8. Regulatory E-Filing for DIN Services

All DIN-related filings are done through the MCA Portal (www.mca.gov.in). These include:

• DIR-3 (New DIN Application)

• DIR-5 (DIN Surrender)

• DIR-6 (Updating DIN Details)

• DIR-3 KYC / DIR-eKYC (Annual KYC Compliance)

9. Case Study: Importance of Timely DIN Compliance

Scenario:

A director failed to complete DIR-KYC for two consecutive years. As a result:

• His DIN was marked as ‘deactivated due to non-filing’.

• He could not be reappointed in a new company until his DIN was reactivated.

• After paying a late fee of INR 10,000, his DIN was restored, highlighting the importance of annual compliance.

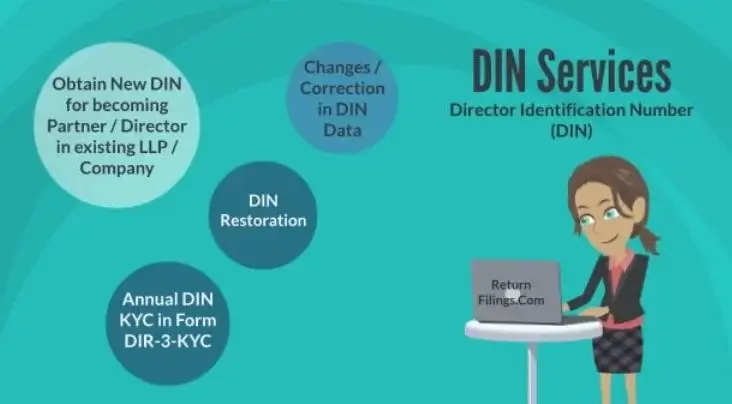

10. How We Can Help

At ReturnFilings.Com, we provide end-to-end assistance for:

• DIN application and verification

• Annual DIR-KYC compliance

• Updating personal details linked to DIN

• Resolving inactive DIN issues and regulatory filings

By following the latest DIN regulations and staying compliant, directors and partners can ensure smooth business operations and avoid legal penalties.

Our experts ensure seamless compliance, allowing you to focus on business while we handle the regulatory processes.

For professional assistance, reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091 to ensure all statutory obligations are met on time.

frequently asked questions (faq's) related to Director identification number (DIN) services

Q What is a DIN (Director Identification Number)?+

A A DIN is a unique 8-digit alphanumeric identification number assigned to an individual who is eligible to be a director of a company in India. It's a mandatory requirement for anyone wanting to serve on a company's board. Once allotted, it remains the same for the individual, regardless of the number of companies they are associated with.

Q Why is a DIN required?+

A A DIN is required to track and regulate directors across different companies, prevent fraudulent activities and misuse of directorships, maintain a centralized database of director information, and promote transparency and accountability in corporate governance.

Q Who needs a DIN?+

A Any individual who wants to be appointed as a director in any company in India needs to obtain a DIN.

Q How do I apply for a DIN?+

A DIN is applied for online through the Ministry of Corporate Affairs (MCA) portal using Form DIR-3.

Q What is the process for applying for a DIN?+

A The process generally involves:

• Visiting the MCA portal

• Filling out the online DIR-3 form with accurate personal and contact details

• Uploading scanned copies of required documents (Aadhaar, PAN, address proof)

• Paying the prescribed application fee online

• Submitting the form

Q What documents are required for applying for a DIN?+

A Generally, the following documents are required:

• Proof of Identity (Aadhaar, Passport, Voter ID, Driving License)

• Proof of Address (Aadhaar, Passport, Utility Bills)

• PAN Card (mandatory)

• Photograph

Q What are the fees for applying for a DIN?+

A The fees for applying for a DIN are prescribed by the MCA and are subject to change. Check the MCA website for the latest fee structure.

Q How long does it take to get a DIN after applying?+

A The processing time for DIN applications varies. It typically takes a few days to a few weeks, depending on the volume of applications and verification processes.

Q Can I track the status of my DIN application?+

A Yes, you can track the status of your DIN application on the MCA portal.

Q How do I know my DIN?+

A If you have been allotted a DIN, you can find it on the MCA portal by searching with your name or PAN.

Q Can I have more than one DIN?+

A No, an individual can only have one DIN.

Q How do I update my information related to DIN?+

A Any changes in personal details (address, contact information, etc.) must be updated with the MCA through the appropriate forms (DIR-6).

Q What is Form DIR-6?+

A Form DIR-6 is used for intimating changes in director details, including changes in address, contact information, or other personal details.

Q What happens if I don't update my DIN information?+

A Failure to update DIN information can lead to penalties and may affect your ability to serve as a director.

Q When can a DIN be deactivated?+

A A DIN can be deactivated due to various reasons, including death of the individual, declaration of insolvency, conviction for certain offenses, or non-compliance with KYC requirements.

Q How can I reactivate a deactivated DIN?+

A A deactivated DIN can be reactivated by applying to the MCA and providing the necessary documents and paying the required fees.

Q Can a foreign national obtain a DIN?+

A Yes, foreign nationals can obtain a DIN if they are eligible to be directors of a company in India.

Q Is DIN required for designated partners in LLPs?+

A Designated partners in LLPs do not use the same DIN. They have a Designated Partner Identification Number (DPIN).

Q Where can I find the latest notifications and circulars related to DIN?+

A The MCA website is the official source for all notifications and circulars related to DIN.

Q How do I download the DIR-3 form?+

A The DIR-3 form is available for download on the MCA portal.

Q What is the validity of a DIN?+

A A DIN is valid for the lifetime of the individual unless it is deactivated by the MCA.

Q How can I check if a person has a DIN?+

A You can search for a DIN on the MCA portal using the person's name or PAN.

Q What is the process for surrendering a DIN?+

A You can apply to the MCA for surrender of your DIN under specific circumstances.

Q Can a company appoint a person as a director without a DIN?+

A No, a person must have a DIN to be appointed as a director of a company.

Q What are the consequences of providing false information in the DIR-3 form?+

A Providing false information can lead to legal action and penalties.

Q How can I update my PAN details linked to my DIN?+

A You need to update your PAN details with the Income Tax Department, and the updated information will be reflected in the MCA database.

Q What if I forget my password for the MCA portal?+

A You can use the "Forgot Password" option on the MCA portal to reset your password.

Q How can I contact the MCA helpdesk for DIN related queries?+

A Contact details are available on the MCA website.

Q What are the common issues faced while applying for a DIN?+

A Common issues include errors in filling the form, problems with document uploads, or payment gateway issues.

- For further reading, explore the following topics:

- 📑 How to File DIR-3 KYC e-Form in India: Step-by-Step Guide for Directors (FY 2025-26)

- 💸 Tax Reliefs Available in Deductions & Exemptions for Salaried & Self-Employed

- 💰 Step-by-Step Procedure to Raise Authorized Share Capital in Indian Companies

- 📝 Procedure to Change Memorandum and Articles of Association in India