How to Change Registered Address of Company or LLP in India: Stepwise Guide

1. Introduction

The registered address of a company or Limited Liability Partnership (LLP) is the official address recorded with the Ministry of Corporate Affairs (MCA) at the time of incorporation. This address is used for legal correspondence, tax registration, and other regulatory purposes. However, due to business expansion, operational convenience, or legal compliance, companies may need to change their registered office address.

2. Importance of Registered Address

The registered address plays a crucial role in:

• Legal Compliance: All official communications and notices from regulatory authorities are sent to this address.

• Taxation & Stamp Duty: The stamp duty for incorporation varies based on the state where the company is registered.

• Operational Efficiency: Businesses often shift their offices for ease of operations, better infrastructure, or to be closer to customers and markets.

• Government Incentives: Certain states offer tax benefits, subsidies, or relaxed compliance requirements, prompting businesses to relocate.

3. Types of Change in Registered Address

There are two primary scenarios for changing a registered address:

3.1. Change of Address Within the Same State

• The address change occurs within the same city or between cities within the same state.

• Approval from the Board of Directors/Partners is required.

• Only a Board Resolution and MCA filing are needed.

3.2. Change of Address to Another State

• The company/LLP is shifting its registered office from one state to another.

• Approval from Shareholders, MCA, and Regional Director (RD) is required.

• The Memorandum of Association (MOA) must be amended.

• Public notice and consent from creditors/debtors are required.

4. Step-by-Step Procedure for Changing Registered Address

4.1. Procedure for Change Within the Same State

Step 1: Board Meeting Resolution

• Convene a Board Meeting to approve the change of address.

• Pass a resolution authorizing the change.

• Approve the filing of necessary forms with the MCA.

Step 2: Filing of E-Form INC-22

• File e-Form INC-22 with the MCA within 30 days of passing the resolution.

• Attach the following documents:

o Certified copy of the Board Resolution.

o Proof of new address (Rental Agreement, Utility Bill, etc.).

o NOC from the owner (if premises are rented).

Step 3: Verification and Approval

• The MCA verifies the submitted documents.

• Upon approval, the registered address is updated in the MCA records.

4.2. Procedure for Change of Address to Another State

Step 1: Board Meeting & Shareholder Approval

• Convene a Board Meeting to approve the address change.

• Schedule a General Meeting and pass a Special Resolution for altering the registered office and MOA.

Step 2: File E-Forms with MCA

• INC-23: Application for Regional Director (RD) approval.

• INC-22: Notice of change in registered address.

• MGT-14: Filing of Special Resolution with MCA.

Step 3: Publish Newspaper Advertisement

• Publish a notice of address change in one English and one vernacular newspaper.

• Notify creditors and debtors about the change.

Step 4: Obtain Regional Director Approval

• The Regional Director (RD) reviews the application.

• Upon approval, the company files INC-28 to register the order.

Step 5: Update MOA & Inform Authorities

• Amend the Memorandum of Association (MOA) with the new address.

• Update records with GST, Income Tax, Banks, and other regulators.

5. Consequences of Non-Compliance

• Failure to update the registered address may result in penalties and legal complications.

• Non-receipt of legal notices can lead to adverse judgments.

• MCA imposes a fine ranging from INR 10,000 to INR 1,00,000 for non-compliance.

6. Case Study: Importance of Address Update

Scenario:

A company originally registered in Mumbai relocated to Bangalore for better market reach but did not update its registered address with the MCA. As a result:

• Official communications and legal notices were still sent to the Mumbai address.

• The company missed an important tax notice, leading to penalty imposition by the Income Tax Department.

• After a delayed compliance process, the company had to pay hefty late filing fees to rectify the issue.

Key Takeaway: Timely updating of the registered address ensures compliance and prevents unnecessary legal risks.

7. How We Can Help

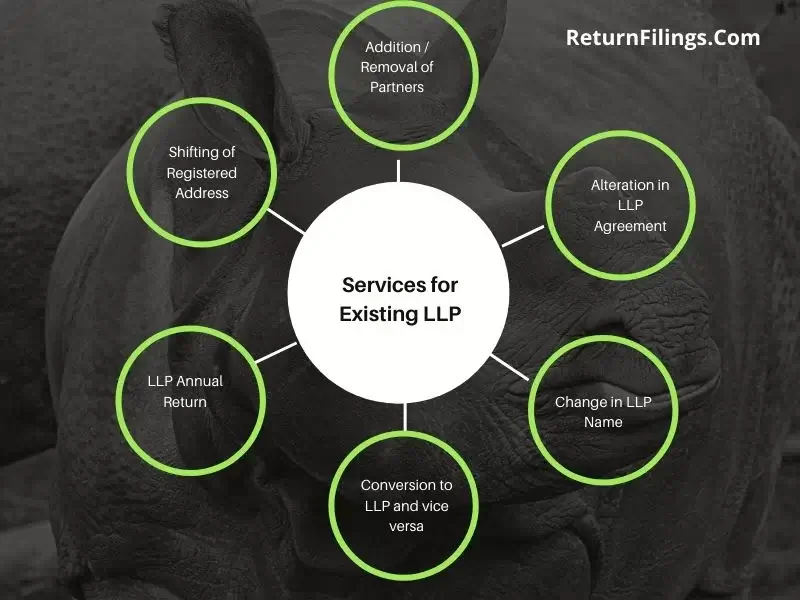

At ReturnFilings.Com, we provide end-to-end services for:

• Legal Consultation & Documentation

• Board & Shareholder Resolution Drafting

• Filing of MCA Forms (INC-22, INC-23, INC-28, MGT-14, etc.)

• Liaising with Authorities for Seamless Approval

By staying compliant with MCA regulations, businesses can operate smoothly and avoid legal hassles. If you need assistance with the registered office change process, feel free to reach out to ReturnFilings.Com for expert support!

For professional assistance, reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091 to ensure all statutory obligations are met on time.

frequently asked questions (faq's) related to Change in Registered Address of Company/LLP

Q What is the registered address of a company/LLP?+

A The registered address is the official address of a company or LLP, as recorded with the Registrar of Companies (ROC). It's the address where all official communications, notices, and legal documents are sent. It must be a physical address, not a P.O. Box.

Q Why is the registered address important?+

A The registered address is crucial because:

• It's the official address for all legal and regulatory communications.

• It determines the jurisdiction of the company/LLP for legal and administrative purposes.

• It's a publicly available record, providing transparency about the company/LLP's location.

Q Can a company/LLP have multiple registered addresses?+

A No, a company/LLP can have only one registered address.

Q What is the process for changing the registered address within the same city/town?+

A The process generally involves:

• Passing a resolution by the Board of Directors/Designated Partners

• Filing Form INC-22 (for companies) or Form LLP-6 (for LLPs) with the ROC within 30 days of the resolution

• Paying the prescribed fees

• Updating the company/LLP's records and stationery

Q What documents are required for changing the registered address within the same city/town?+

A Required documents typically include:

• Board resolution/consent of designated partners

• Proof of the new registered address (e.g., rent agreement, utility bill)

• No Objection Certificate (NOC) from the landlord (if applicable)

Q What is the process for changing the registered address to a different city/town within the same state?+

A The process is similar to changing within the same city but may involve additional steps, such as:

• Passing a special resolution by the shareholders/members

• Filing Form INC-22 (for companies) or Form LLP-6 (for LLPs) with the ROC

• Publishing an advertisement in a local newspaper

• Obtaining NOC from the relevant authorities (if required)

Q Are there any specific requirements for changing the registered address to a different city/town?+

A Yes, there might be specific requirements based on the state's regulations. It's essential to check with the ROC for any state-specific requirements.

Q What is the process for changing the registered address to a different state?+

A Changing the registered address to a different state is more complex and involves:

• Passing a special resolution

• Obtaining NOC from the ROC of the current state

• Filing an application with the ROC of the new state

• Publishing an advertisement in newspapers in both states

• Filing various forms, including INC-22 (for companies) or LLP-6 (for LLPs), and other forms as specified

Q What are the key considerations when changing the registered address to a different state?+

A Key considerations include:

• Compliance with the laws of both the current and the new state

• Impact on tax registration and other registrations

• Logistical arrangements for shifting operations (if applicable)

Q What are the fees for changing the registered address?+

A The fees vary depending on the type of company/LLP and the state. Check the MCA website for the latest fee structure.

Q How long does it take to complete the process of changing the registered address?+

A The time frame varies depending on the complexity of the change and the ROC's processing time.

Q What happens if a company/LLP fails to update its registered address with the ROC?+

A Failure to update the registered address can lead to penalties and legal consequences.

Q Can a company/LLP change its registered address multiple times?+

A Yes, a company/LLP can change its registered address multiple times, following the prescribed procedures each time.

Q How do I find the registered address of a company/LLP?+

A You can find the registered address on the MCA website by searching for the company/LLP.

Q What is the significance of the PIN code in the registered address?+

A The PIN code is an essential part of the address and helps in postal delivery.

Q Can a company/LLP use a virtual office address as its registered address?+

A The regulations generally require a physical address, not a virtual office. Specific regulations must be consulted.

Q What are the implications of changing the registered address for tax purposes?+

A Changing the registered address may have implications for tax registration and filing. Consult a tax professional.

Q How do I update the registered address on the company/LLP's website and other documents?+

A After the ROC approves the change, you need to update the address on all official documents and the website.

Q What is the role of the Registrar of Companies in the process of changing the registered address?+

A The ROC approves the change and updates the company/LLP's records.

Q What are the common challenges faced while changing the registered address?+

A Challenges can include obtaining NOCs, complying with procedural requirements, and coordinating with different authorities.

Q How can I ensure a smooth transition when changing the registered address?+

A Proper planning and coordination are essential for a smooth transition.

Q What are the regulations regarding the display of the registered address at the company/LLP's premises?+

A The company/LLP is usually required to display its name and registered address at its registered office in a conspicuous place, as per the Companies Act and local regulations.

Q Where can I find the latest MCA notifications and circulars related to changes in registered address?+

A The MCA website is the official source for notifications and circulars.

- For further reading, explore the following topics:

- 🏢 How to Change a Company Name in India – Step-by-Step ROC Process

- 📑 How to Change LLP Name in India: Legal Procedure, Compliance & Case Study

- 💡 Tax Planning Strategies in India : Maximizing Deductions & Exemptions

- 👥 How to Add or Remove a Partner in an LLP in India