Blog

1. Requirement of TDS on Sale and Purchase of Property As per Section 194-IA of the Income Tax Act, 1961, Tax Deducted …

In India, the taxation of cryptocurrency is governed by rules introduced in the Union Budget 2022, which came into effect from April …

The Direct Tax Code (DTC) and the Income Tax Act, 1961 both aim to govern the taxation system in India but differ …

The Union Budget 2024, presented by India’s Finance Minister, brought a host of changes in the country’s tax regime, with significant modifications …

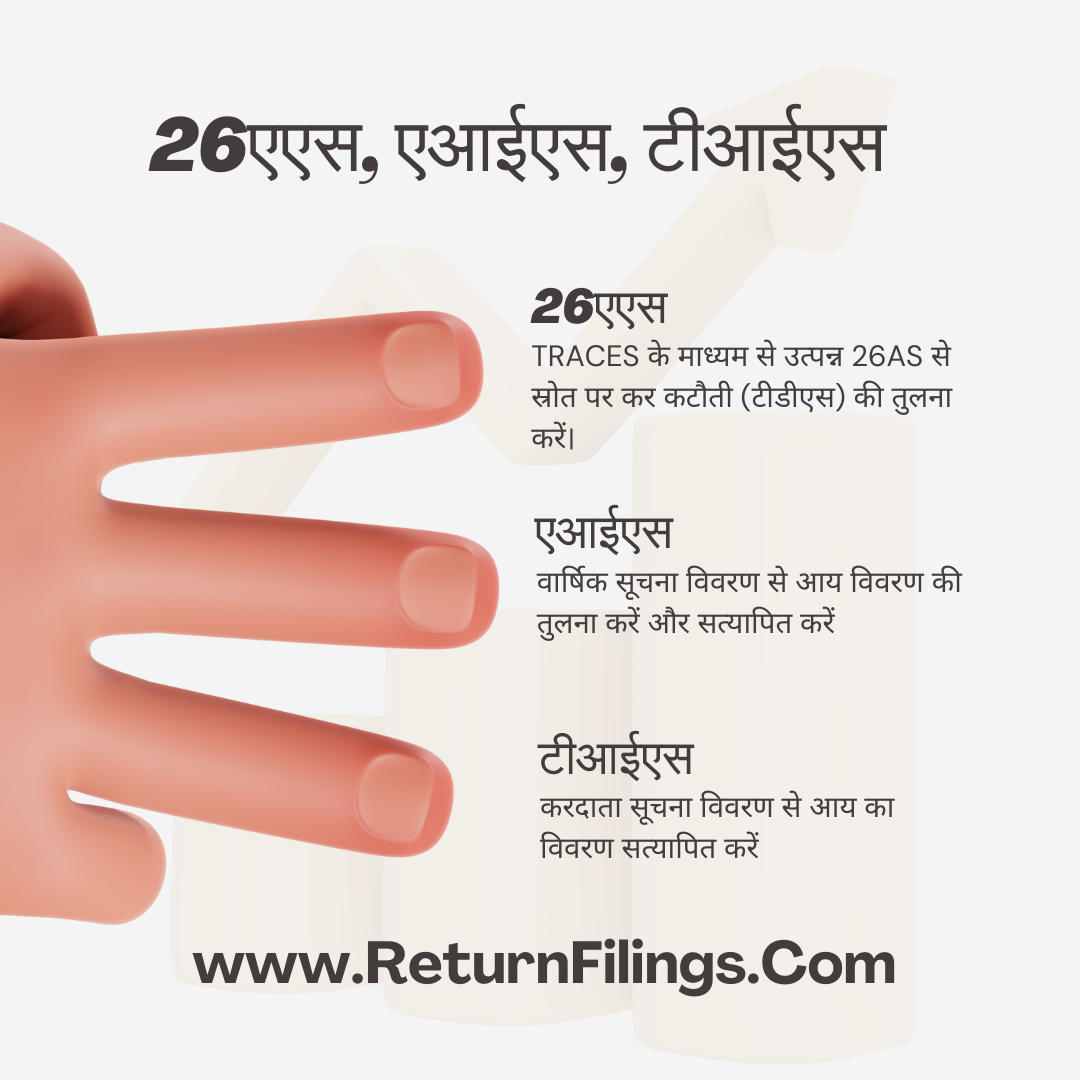

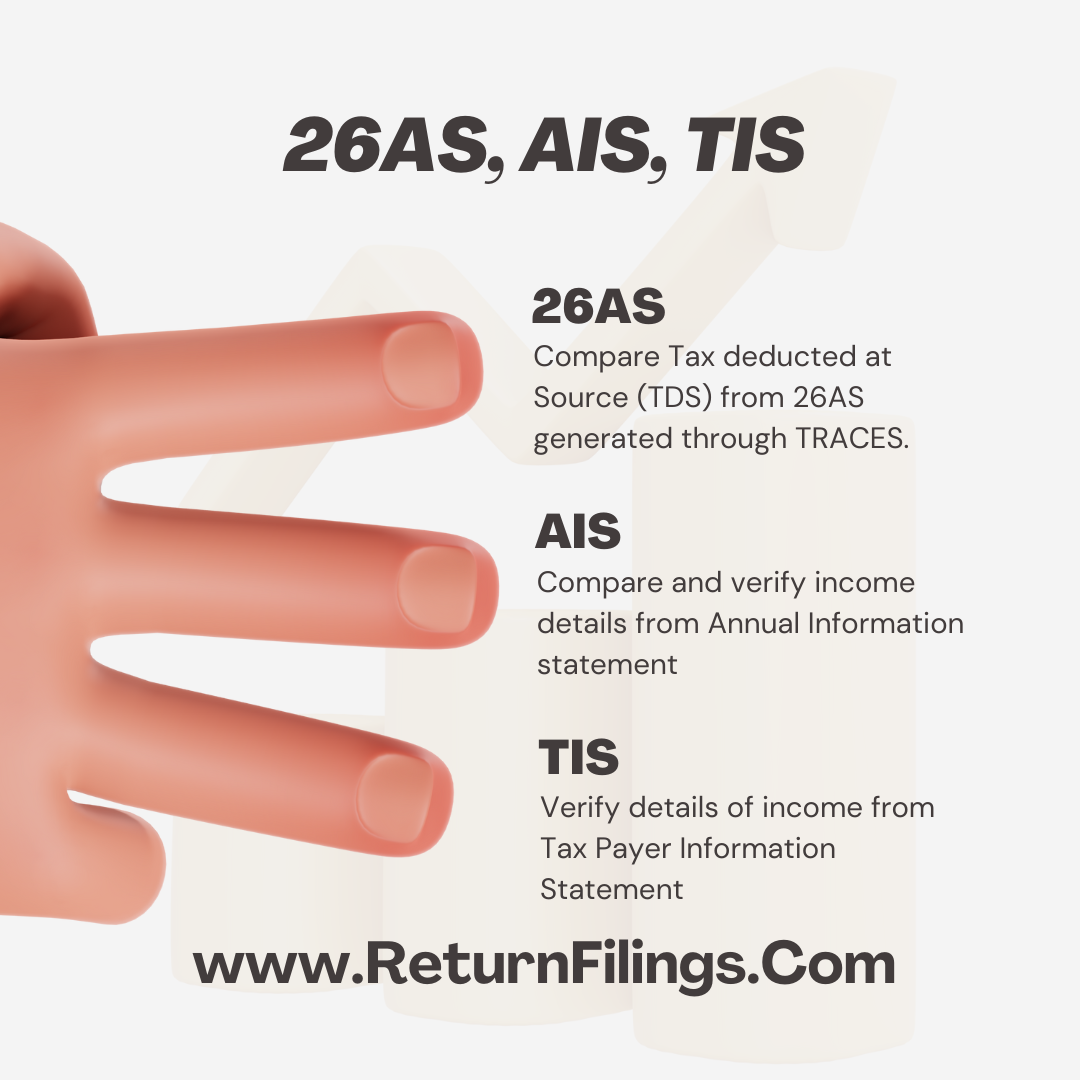

कर अधिकारियों के नोटिस और जुर्माने से बचने के लिए सटीक कर रिटर्न दाखिल करना महत्वपूर्ण है। इसके लिए आपके स्रोत पर …

Filing accurate tax returns is crucial to avoid notices and penalties from tax authorities. This requires a thorough verification of your Tax …

Introduction: In the realm of corporate governance, Director Identification Number (DIN) plays a pivotal role, particularly in jurisdictions like India. This unique …

परिचय: कॉर्पोरेट प्रशासन के क्षेत्र में, निदेशक पहचान संख्या (डीआईएन) एक महत्वपूर्ण भूमिका निभाती है, खासकर भारत जैसे न्यायक्षेत्रों में। यह विशिष्ट …

फॉर्म 10IEA भारतीय आयकर विभाग द्वारा बजट 2023 में करदाताओं को पुरानी और नई कर व्यवस्थाओं के बीच चयन करने का विकल्प …

Form 10IEA is a crucial form introduced by the Indian Income Tax Department in Budget 2023 to provide taxpayers with the option …

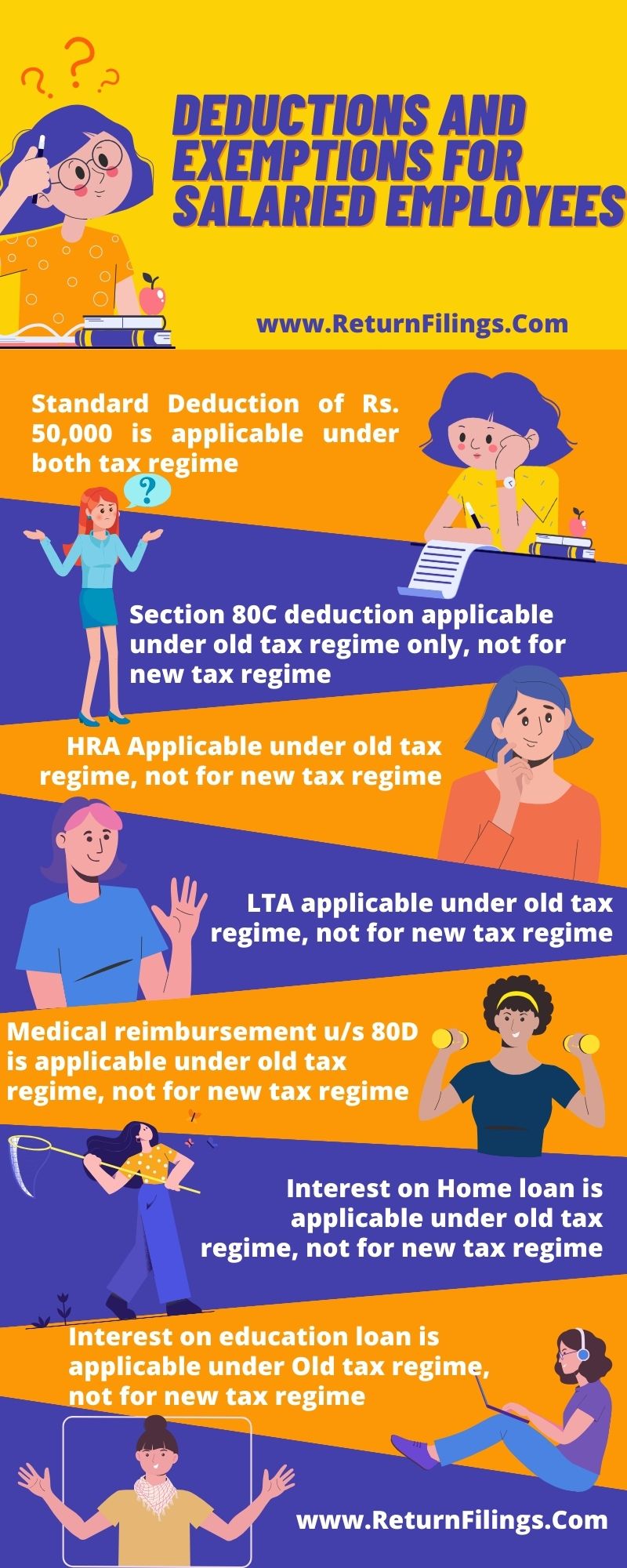

Income tax regulations in India undergo periodic changes, affecting how taxpayers manage their financial affairs. Salaried employees, in particular, benefit from various …

The tax landscape in India has undergone significant transformations over the years, with the introduction of the old tax regime and subsequently …