As stated in our previous blog, there are 7 types of Income Tax Return. This article is about guidelines on filing ITR-1.

- What is ITR-1

- Who can file ITR-1

- Who cannot file ITR-1

- Last date for filing ITR-1 for AY 2024-25 i.e. FY 2023-24

- Prerequisite / Documents required to file ITR-1

- Decision on claiming old tax regime / new tax regime.

What is ITR-1?

Central Board of Direct Taxes (CBDT) had notified ITR-1 and ITR-4 forms for AY 2024-25 (i.e. FY 2023-24) on 22nd December 2023.

Ministry of Finance had released press note on 04th April 2024 stating that online functionality for filing Income Tax Return (ITR) Forms on Income Tax Portal for Assessment Year AY 2024-25 (i.e. Financial Year FY 2023-24) is active from 01st April 2024.

Income Tax Return Form-1 (ITR-1) is also known as SAHAJ.

ITR-1 (SAHAJ) is one of the simplest Income tax return forms amongst all other Income Tax Return Forms.

ITR-1 is on online based Tax return form, filed using login on Income Tax portal.

Who can file ITR-1 (SAHAJ)?

Any individual person having income of up-to INR 50 lakhs can file ITR-1 (SAHAJ)

Following sources of income can be declared in ITR-1 (SAHAJ):

- Income from Salary / Pension (If any individual has income from multiple employers, that need to be clubbed together)

- Income from one house property (In case if there is any loss which need to be carried forward or which is bought forward from previous years, then in such cases ITR-2 is applicable)

- Income from Other Sources (excluding income from horse race and income from lottery or windfall gain)

- Income from Dividend (excluding profit / loss from sale of shares, in case if there is profit / loss from sale of shares then ITR-2 is applicable)

- Clubbing of income from spouse or minor is allowed in ITR-1 subject to income chargeable to tax up-to INR 50 lakhs and from same head of income as required for ITR-1.

Who cannot file ITR-1 (SAHAJ)?

- Individuals having taxable income exceeding INR 50 lakhs.

- Non-Residents and Residents not ordinarily residents (NR and RNOR)

- Any individual who is either a director of a company or has held any unlisted equity shares at any time during the financial year.

- Individuals having more than one house property.

- Individuals having income from Lottery, racehorses, legal gambling, etc

- Individuals having income from sale / purchase of shares or taxable capital gain or loss (either short term or long term)

- Individuals having agricultural income exceeding INR 5,000.

- Any individual having any asset outside India.

- Individuals claiming relief from Foreign Tax paid.

- Profit or Gain from Virtual digital asset (i.e. Crypto currency)

Last date for filing ITR-1 for AY 2024-25 i.e. FY 2023-24

For Assessment Year (AY) 2024-25 i.e. Financial Year (FY) 2023-24, due date of filing of ITR-1 (SAHAJ) is 31st July 2024, unless extended by the Government.

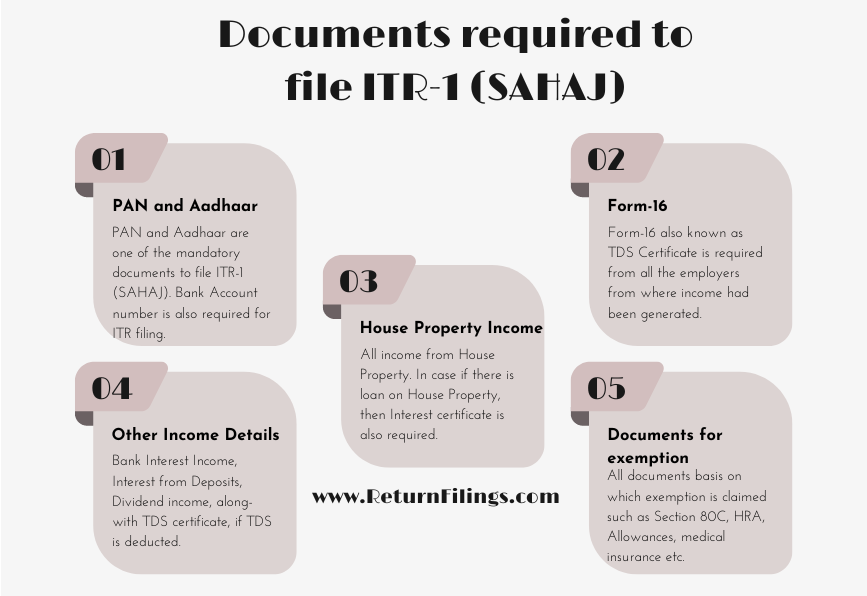

Prerequisite / Documents required to file ITR-1

- Aadhaar number is mandatory to mention for filing ITR-1

- PAN card

- Form-16 / TDS certificate is required from all the employers.

- TDS certificate from Banks / Financial institutions in case TDS is deducted on interest income.

- Income from House property details with details of housing loan (if any).

- All proof of documents of investments which an individual intends to claim in ITR-1, such as HRA, Children education allowance, Deduction u/s 80C etc.

- Bank Interest details, Dividend income details, interest on tax refund details of previous year.

Decision on Claiming old tax regime / new tax regime.

During Current AY 2024-25 (i.e. FY 2023-24) the default tax return filing is under new tax regime, in case if an individual intends to claim old tax regime, then there is requirement to opt-out from new tax regime and to fulfil this requirement, individual need to submit form 10-IEA before proceeding to file ITR-1 (SAHAJ).