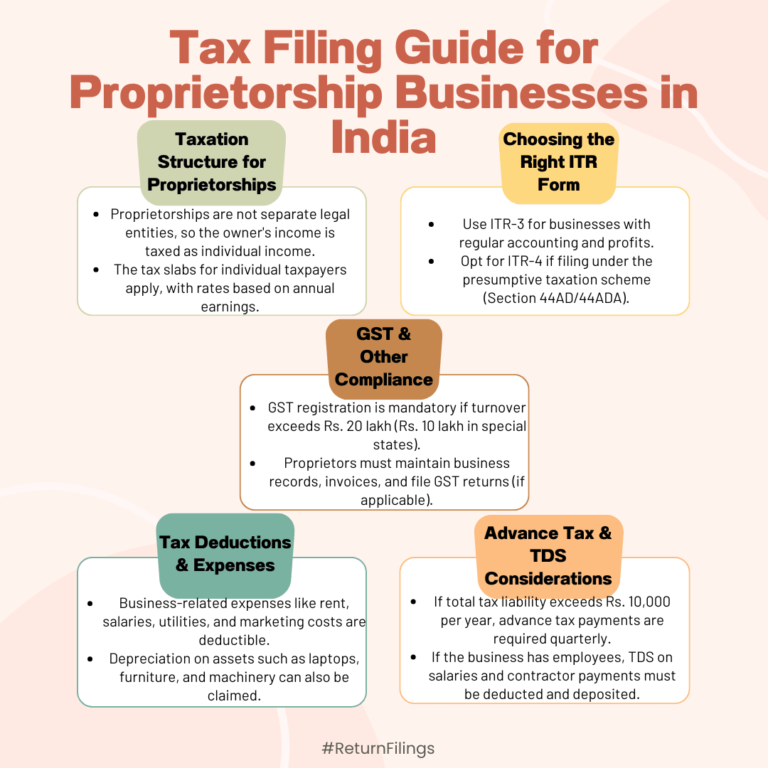

Proprietorship income is taxed as individual income; use ITR-3 or ITR-4, claim business expenses, and comply with GST and advance tax.

This infographic outlines tax filing for proprietorship businesses in India. Income is taxed as individual income per slabs. Use ITR-3 for regular accounting or ITR-4 for presumptive taxation. Register for GST if turnover exceeds ₹20 lakh. Claim deductions for business expenses and depreciation. Pay advance tax if liability exceeds ₹10,000, and deduct TDS for employees and contractors.