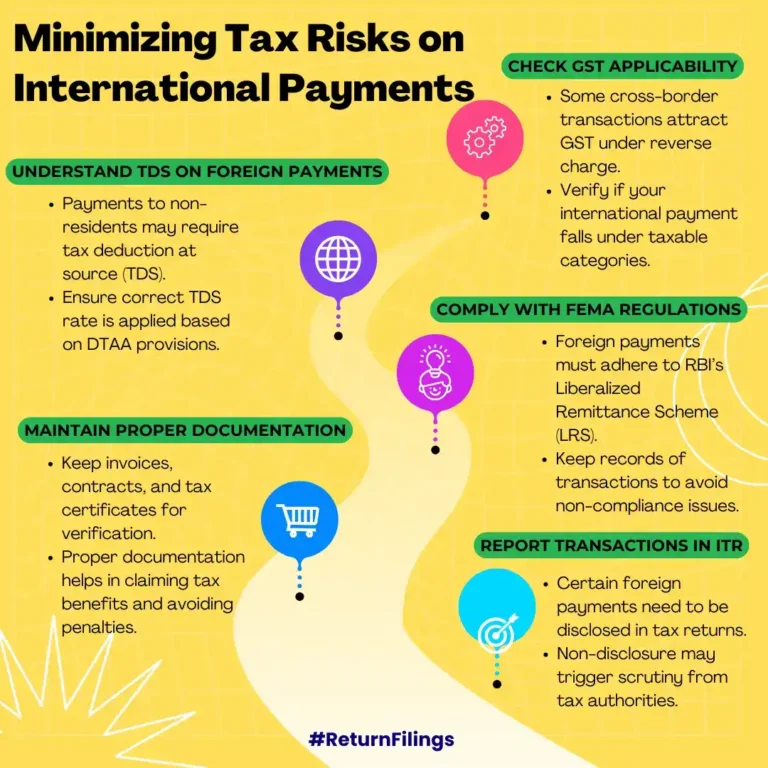

Apply correct TDS rates, check GST applicability, and maintain records to minimize tax risks on foreign payments.

This infographic provides tips to minimize tax risks on international payments from India. Ensure proper TDS deduction as per DTAA, check GST applicability under reverse charge, and comply with FEMA and RBI’s LRS rules. Report relevant transactions in ITR and maintain invoices, contracts, and tax certificates for verification. Proper compliance helps avoid penalties and scrutiny.