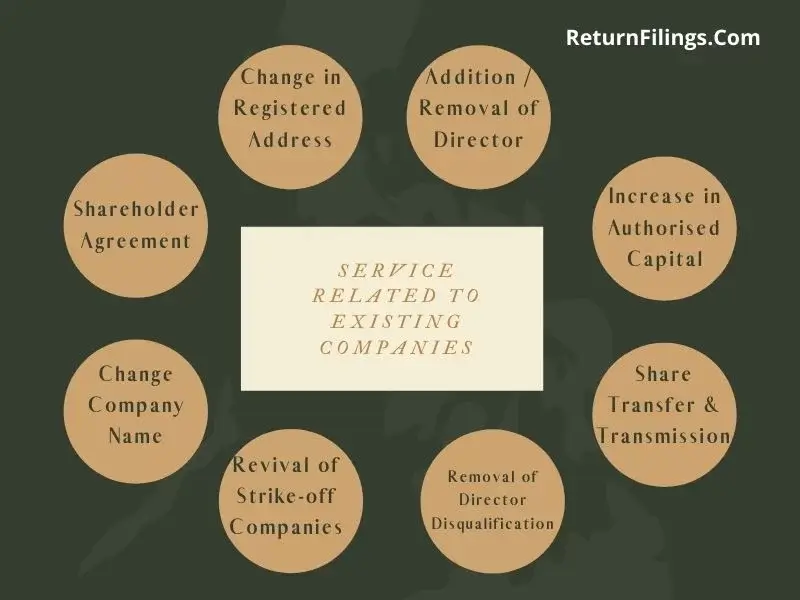

Shareholders Agreement in India: Key Clauses, Legal Aspects & Compliance

1. Introduction to Shareholders Agreement (SHA)

A Shareholders Agreement (SHA) is a legally binding contract among shareholders of a company that outlines their rights, obligations, and responsibilities. The agreement is essential for ensuring transparency, preventing disputes, and protecting the interests of all shareholders, including minority stakeholders.

2. Purpose of a Shareholders Agreement

Executing a SHA serves multiple purposes, including:

• Defining Rights and Obligations: Clearly setting out shareholders’ rights and duties.

• Protection of Interests: Safeguarding the financial and management interests of shareholders.

• Minority Shareholder Protection: Ensuring fair treatment and adequate representation.

• Regulation of Share Transfer and Transmission: Establishing procedures for the sale or transfer of shares.

• Ensuring Smooth Corporate Governance: Clarifying governance structures and decision-making processes.

3. Key Contents of a Shareholders Agreement

3.1 Definitions and Parties

This section provides definitions of key terms used in the agreement and details the parties involved, such as individual shareholders, key management personnel (KMP), and the company itself.

3.2 Management of the Company

• Role of Key Management Personnel (KMP): Specifies responsibilities of directors, CEOs, CFOs, and other officers.

• Governance Framework: Lays out management structure and delegation of powers.

3.3 Board of Directors

• Composition: Defines the number of directors, qualifications, and tenure.

• Committees: Details board committees such as audit, risk management, and remuneration committees.

• Voting Rights: Specifies voting mechanisms and veto rights, if any.

3.4 Shareholder Rights and Obligations

• Right to Vote: Shareholders’ participation in company decisions through voting rights.

• Right to Call a General Meeting: The ability of shareholders to request meetings.

• Right to Appoint Directors and Auditors: Shareholders’ power to influence management appointments.

• Inspection Rights: Shareholders’ right to review financial statements and company records.

3.5 Transfer and Transmission of Shares

• Lock-in Period: Restrictions on selling shares within a specified timeframe.

• Right of First Refusal (ROFR): Ensures existing shareholders get priority in buying shares.

• Tag-Along and Drag-Along Rights:

o Tag-Along: Protects minority shareholders by allowing them to sell their shares if a majority shareholder sells theirs.

o Drag-Along: Allows majority shareholders to compel minority shareholders to sell their shares in case of an acquisition.

3.6 Quorum Requirements

• Defines the minimum number of shareholders or directors required for making corporate decisions.

3.7 Valuation of Shares

• Valuation Methodologies: Specifies whether valuation will be done based on market price, book value, or any other recognized method.

• Earnings Per Share (EPS) Calculation: Guidelines for financial evaluations.

3.8 Liabilities of Shareholders

• Unpaid Share Capital: Specifies liability for unpaid shares.

• Limited Liability: Clarifies that shareholders are not personally responsible for the company’s debts beyond their investment.

3.9 Protection of Minority Shareholders

• Representation on the Board: Allowing minority shareholders to nominate directors.

• Veto Rights: Special protections to prevent decisions that disproportionately impact minority shareholders.

3.10 Dispute Resolution Mechanism

• Arbitration Clause: Specifies arbitration as a means of resolving shareholder disputes.

• Mediation and Conciliation: Alternative dispute resolution methods.

• Jurisdiction: Court jurisdiction in case of legal proceedings.

3.11 Termination of the Agreement

• Automatic Termination: Circumstances under which the SHA ceases to be effective (e.g., dissolution of the company).

• Mutual Agreement: Process for shareholders to mutually terminate the agreement.

4. Legal and Compliance Aspects

• Companies Act, 2013: SHA should comply with the provisions of the Companies Act, 2013.

• Securities and Exchange Board of India (SEBI) Regulations: If the company is listed, compliance with SEBI norms is mandatory.

• Stamp Duty & Notarization: The agreement must be duly stamped as per the Indian Stamp Act and may require notarization.

5. Case Studies & Examples

Case Study 1: Protecting Minority Shareholders

A startup with three founders entered into a SHA ensuring that no major decision could be taken without unanimous consent. This safeguarded the minority shareholder’s interests even though he held only a 20% stake.

Case Study 2: Avoiding Disputes in Share Transfers

A private limited company included a Right of First Refusal clause in their SHA. When one shareholder decided to exit, the existing shareholders were given the first opportunity to buy the shares, preventing an outsider from entering the company.

6. Conclusion

A well-drafted Shareholders Agreement is vital for defining the relationship between shareholders and ensuring smooth corporate governance. It prevents future disputes, safeguards interests, and ensures regulatory compliance. For professional assistance, reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091 in drafting and reviewing Shareholders Agreement (SHA) to align with business goals and legal requirements.

frequently asked questions (faq's) related to Shareholders' Agreement

Q What is a Shareholders' Agreement (SHA)?+

A A Shareholders' Agreement (SHA) is a legally binding contract between some or all of the shareholders of a company. It supplements the company's Articles of Association (AoA) and governs the relationship between the shareholders, including matters such as share transfers, board representation, and decision-making. It's a private agreement between the shareholders, while the AoA governs the company's internal management.

Q Why is a Shareholders' Agreement important?+

A An SHA is important because it:

• Protects the interests of minority shareholders.

• Provides clarity on the rights and obligations of shareholders.

• Helps prevent disputes and misunderstandings.

• Establishes a framework for decision-making and corporate governance.

• Facilitates smooth transfer of shares.

• Can address exit strategies for shareholders.

Q Who are the parties to a Shareholders' Agreement?+

A The parties to an SHA are typically the shareholders of the company. Sometimes, the company itself is also a party to the SHA.

Q Is a Shareholders' Agreement legally binding?+

A Yes, a properly drafted SHA is a legally binding contract enforceable in a court of law.

Q Is a Shareholders' Agreement publicly available?+

A No, a Shareholders' Agreement is a private document between the shareholders and is not publicly available. It's kept confidential.

Q What are some common provisions included in an SHA?+

A Common provisions include:

• Share Transfer Restrictions (right of first refusal, tag-along rights, drag-along rights)

• Board Representation

• Decision-Making (matters requiring unanimous or super-majority approval)

• Exit Strategies (buy-out provisions, put options, call options)

• Dividend Policy

• Dispute Resolution

• Confidentiality

• Non-Compete clauses

Q What is Right of First Refusal (ROFR)?+

A ROFR gives existing shareholders the first right to purchase shares being sold by another shareholder before they are offered to a third party.

Q What are Tag-Along Rights?+

A Tag-along rights allow minority shareholders to participate in a sale of shares by majority shareholders on the same terms.

Q What are Drag-Along Rights?+

A Drag-along rights allow majority shareholders to compel minority shareholders to sell their shares in a sale of the company.

Q What are Put Options and Call Options?+

A Put Option: Gives a shareholder the right to sell their shares to another shareholder or the company at a predetermined price.

Call Option: Gives a shareholder or the company the right to buy shares from another shareholder at a predetermined price.

Q Who drafts a Shareholders' Agreement?+

A An SHA is typically drafted by a professional specializing in corporate law.

Q What is the role of a professional in drafting an SHA?+

A A professional can advise on the legal implications of the SHA, ensure that it is legally sound and enforceable, and negotiate the terms on behalf of the shareholders.

Q How is a Shareholders' Agreement enforced?+

A An SHA is a legally binding contract enforceable in a court of law. If a party breaches the SHA, the other parties can seek legal remedies.

Q Can a Shareholders' Agreement override the Articles of Association?+

A No, an SHA cannot override the AoA. If there is a conflict, the AoA prevails. The SHA supplements the AoA and governs the relationship between shareholders.

Q Is a Shareholders' Agreement mandatory?+

A No, an SHA is not mandatory, but it is highly recommended, especially when there are multiple shareholders, minority shareholders, or investors involved.

Q Can a Shareholders' Agreement be amended?+

A Yes, an SHA can be amended with the mutual consent of all the parties to the agreement.

Q What is the duration of a Shareholders' Agreement?+

A The duration can be specified in the SHA. If no duration is specified, it typically remains in effect until the company is dissolved or the agreement is terminated by mutual consent.

Q How do I create a Shareholders' Agreement?+

A For professional assistance, reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091 to draft or create a Shareholders’ Agreement (SHA).

Q What are the key considerations when negotiating a Shareholders' Agreement?+

A Key considerations include share transfer restrictions, board representation, decision-making, and exit strategies.

Q What is the difference between a Shareholders' Agreement and a Joint Venture Agreement?+

A An SHA governs the relationship between shareholders in a company, while a Joint Venture Agreement governs the relationship between parties in a joint venture.

Q How can I protect my minority shareholder rights?+

A An SHA is a key tool for protecting minority shareholder rights.

Q What are the tax implications of a Shareholders' Agreement?+

A Consult a tax professional for specific advice or reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091

Q Can a Shareholders' Agreement be used to control the management of a company?+

A Yes, an SHA can be used to influence and control the management, especially concerning board composition and voting rights.

Q How can I resolve disputes related to a Shareholders' Agreement?+

A The SHA should ideally include a dispute resolution mechanism, such as arbitration or mediation.

Q What are the common mistakes to avoid in a Shareholders' Agreement?+

A Common mistakes include ambiguous language, lack of clarity on key provisions, and failure to address potential contingencies.

Q How can I ensure that a Shareholders' Agreement is enforceable?+

A The agreement should be properly drafted, signed by all parties, and comply with applicable laws.

Q Where can I find sample Shareholders' Agreements?+

A While samples can be helpful, it's crucial to customize the agreement to your specific needs with the help of a professional.

- For further reading, explore the following topics:

- ✍️ Compliance checklist for MoA and AoA amendment filing

- 🏢 Public Limited Company Registration in India: Process, Compliance & Tax Benefits

- 👩💼 Types of directors and their appointment procedures in India

- 🔧 Stepwise guide to modifying LLP partnership structure