Everything About PAN Card Application, Correction & Linking in India

1. Introduction to PAN

Permanent Account Number (PAN) is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India. It is essential for filing income tax returns and serves as proof of identity for individuals and entities in India. PAN is issued by two authorized agencies:

• NSDL (National Securities Depository Limited) via tin-nsdl.com

• UTIITSL (UTI Infrastructure Technology and Services Limited) via pan.utiitsl.com

Both platforms provide an online mechanism to apply for PAN.

2. Who Needs a PAN?

PAN is mandatory for all individuals and entities conducting financial transactions in India. It is allotted to seven different types of persons/entities:

a. Natural Individual Person

b. Hindu Undivided Family (HUF)

c. Company

d. Partnership Firm

e. Association of Persons (AoP)

f. Body of Individuals (BoI)

g. Artificial Juridical Person

2.1 PAN for Minors

Minors can also apply for a PAN card. A PAN card for a minor is essential for opening bank accounts, investments, and other financial activities. Parents or guardians apply on their behalf. The required documents include:

• Birth certificate of the minor

• Parent/guardian’s identity proof

• Address proof of the minor’s parent/guardian

• Photograph of the minor (optional)

Upon turning 18, the minor must apply for an update to convert their PAN to an adult PAN with their signature.

3. How to Apply for a PAN Card?

3.1 Application Forms

• Form 49A: For Indian individuals and entities applying for a new PAN.

• Form 49AA: For foreign nationals and foreign entities applying for a PAN in India.

3.2 Methods of Application

PAN applications can be submitted via:

a. Online Mode (using biometric authentication of Aadhaar or Digital Signature)

b. Offline Mode (submitting a physical application via post/courier to NSDL or UTIITSL offices)

3.3 PAN Application for Foreign Nationals

Foreign individuals and entities must provide proof of identity and address. Documents must be attested by:

• Apostille (for Hague Convention countries)

• Indian Embassy/Consulate in the applicant’s country

4. PAN Correction, Reprint, and Surrender

4.1 Changes/Correction in PAN

If there is an error in PAN details, individuals/entities can submit a correction request online through NSDL/UTIITSL portals.

4.2 Reprint of PAN Card

If a PAN card is lost or damaged, a duplicate PAN card can be requested online while retaining the same PAN number.

4.3 Surrender of Duplicate PAN

Holding more than one PAN is illegal under Section 272B of the Income Tax Act and can lead to a penalty of INR 10,000. Duplicate PANs can be surrendered online by specifying the PAN to be retained and the PAN to be deactivated.

5. Linking PAN with Aadhaar

Linking PAN (Permanent Account Number) with Aadhaar has been made mandatory by the Income Tax Department of India to streamline tax compliance, curb duplicate PANs, and improve identity verification. Individuals must ensure their PAN is linked with their Aadhaar to avoid consequences such as PAN becoming inoperative. The linking process can be done online through the Income Tax e-filing portal by paying a nominal fee, especially after the due date. This integration helps in faster tax processing, reduced fraudulent activities, and easier access to government services.

6. PAN 2.0 Initiative

The PAN 2.0 initiative is a modernization effort by the Indian government to streamline PAN issuance and verification. Key features include:

• Instant e-PAN Issuance: Individuals can get an instant PAN using Aadhaar authentication.

• AI-based Fraud Detection: Prevents duplicate and fraudulent PAN applications.

• Integration with Digital India: PAN 2.0 enables smoother integration with e-KYC, banking, and tax systems.

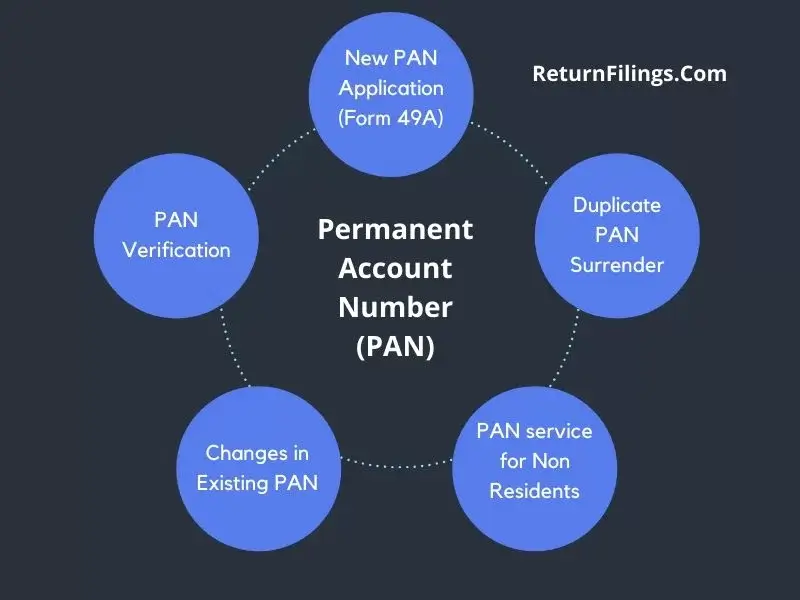

7. How ReturnFilings.com Can Help

We provide complete PAN-related services, including:

• New PAN applications

• PAN verification

• PAN for foreign nationals

• PAN correction and reprint

• Compliance support

For professional assistance, reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091.

frequently asked questions (faq's) related to PAN Application in India

Q What is PAN?+

A PAN stands for Permanent Account Number. It is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India to all taxpayers. PAN is used as a primary key for tracking financial transactions and tax compliance across the country.

Q Why is PAN required?+

A PAN is mandatory for various financial transactions, including:

• Filing income tax returns.

• Opening a bank account.

• Investing in securities.

• Buying or selling property.

• Making high-value transactions.

Q Who needs a PAN?+

A Any individual or entity involved in financial transactions in India, including individuals, businesses, and other organizations, needs a PAN.

Q What are the benefits of having a PAN?+

A Benefits include:

• Facilitates tax compliance.

• Helps track financial transactions.

• Serves as an important identification document.

Q How can I apply for a PAN?+

A You can apply for a PAN online through the NSDL or UTIITSL websites, or offline through designated PAN application centers.

Q What are the different PAN application forms?+

A The common forms are:

• Form 49A: For Indian citizens.

• Form 49AA: For foreign citizens.

Q What documents are required for PAN application?+

A Required documents vary based on the applicant type and application method. Generally, you'll need:

• Proof of Identity (e.g., Aadhaar, passport, driving license).

• Proof of Address (e.g., Aadhaar, utility bills, bank statements).

• Date of Birth proof.

• Photographs.

Q What is the fee for PAN application?+

A The fee varies depending on the application mode (online or offline) and whether you are applying for a new PAN or a duplicate PAN. Check the NSDL or UTIITSL websites for the current fee structure.

Q How long does it take to get a PAN card?+

A The processing time varies. Online applications are usually processed faster than offline applications. It typically takes a few weeks.

Q How can I track the status of my PAN application?+

A You can track the status of your application online through the NSDL or UTIITSL websites by entering your acknowledgement number.

Q What details are printed on a PAN card?+

A A PAN card typically includes:

• Full Name

• PAN

• Father's Name (for individuals)

• Date of Birth

• Photograph

• Signature

Q How can I correct errors in my PAN card details?+

A You can apply for corrections online or offline through the NSDL or UTIITSL websites using the appropriate form and submitting supporting documents.

Q What if I lose my PAN card?+

A You can apply for a duplicate PAN card online or offline through the NSDL or UTIITSL websites.

Q Is it mandatory to link Aadhaar with PAN?+

A Yes, as per government regulations, linking Aadhaar with PAN is mandatory for most taxpayers.

Q How can I link my Aadhaar with PAN?+

A You can link your Aadhaar with PAN online through the Income Tax e-filing portal.

Q What if I have multiple PAN cards?+

A Holding multiple PAN cards is illegal. You should surrender any additional PAN cards to the Income Tax Department.

Q How do I apply for a PAN card online?+

A Covered in the application process details.

Q What is the PAN card application form?+

A Form 49A for Indian citizens, Form 49AA for foreign citizens.

Q What documents are required for PAN application?+

A Proof of identity, address, and date of birth.

Q How much does it cost to apply for a PAN card?+

A Presently it is INR 100 plus GST extra, check the NSDL or UTIITSL websites for the latest fee structure.

Q How can I track my PAN application status?+

A Online through the NSDL or UTIITSL websites using the acknowledgement number.

Q How do I correct errors on my PAN card?+

A Apply for corrections online or offline.

Q How do I link Aadhaar with PAN?+

A Online through the Income Tax e-filing portal.

Q What if I have lost my PAN card?+

A Apply for a duplicate PAN card.

Q Why is PAN important?+

A Mandatory for various financial transactions and tax compliance.

- For further reading, explore the following topics:

- 🔗 How to link PAN card with CKYC registry in India

- 🔢 How to Apply for TAN Registration in India: Process, Documents & Compliance Checklist

- 🏢 How to Register for EPF in India: Eligibility Criteria, Documents Required & Online Procedure

- 👥 How ESI Registration Works in India: Benefits, Applicability & Employer Obligations