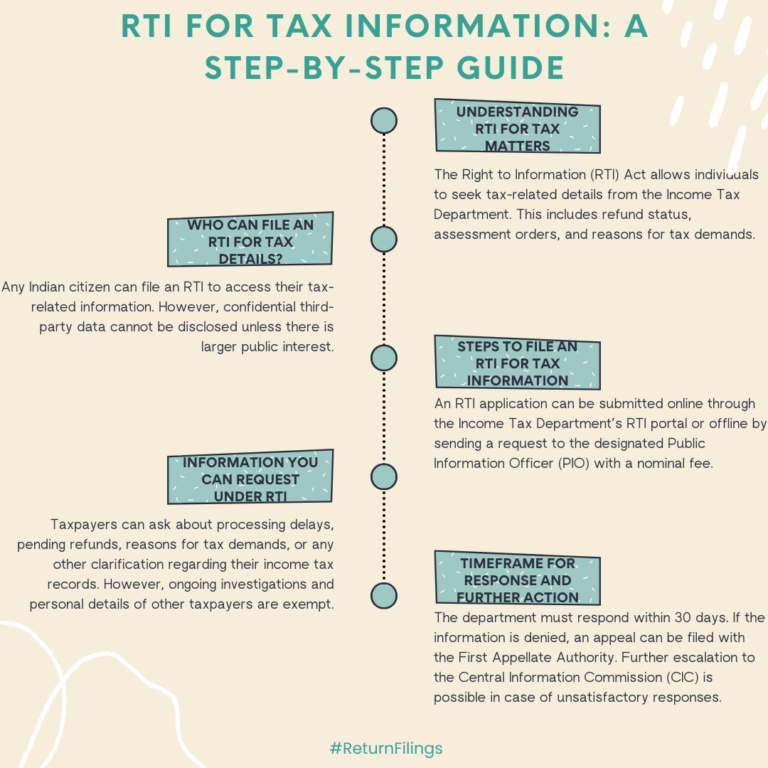

File an RTI application online or offline to seek tax details; department must respond in 30 days or you can appeal further.

This infographic guides taxpayers on using the Right to Information (RTI) Act to access tax-related information. Any Indian citizen can file an RTI to request details like refund status, assessment orders, or reasons for tax demands, but third-party or ongoing investigation data is protected. Submit your RTI online via the Income Tax portal or offline to the Public Information Officer. The department must respond within 30 days; if denied, appeal to the First Appellate Authority or escalate to the Central Information Commission for further review.