Perquisites like housing and cars are taxable; some are exempt; employers deduct TDS and report in Form 16 for ITR filing.

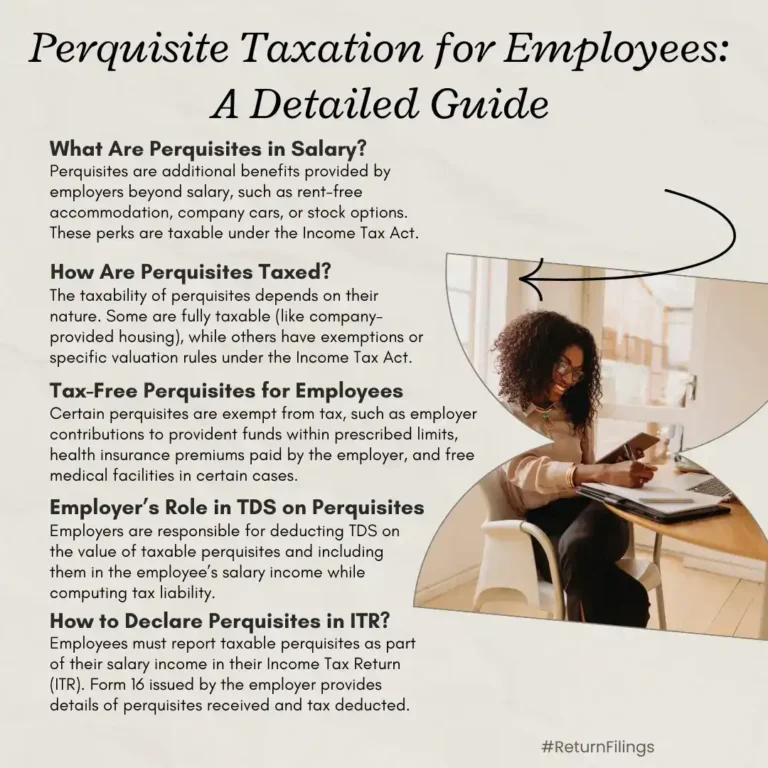

This infographic explains perquisite taxation for employees in India. Perquisites are additional benefits like rent-free accommodation, company cars, or stock options. Their taxability depends on type—some are fully taxable, others exempt or partially exempt. Employers must deduct TDS on taxable perquisites and report them in Form 16. Employees should declare perquisites as part of salary income in their ITR, using Form 16 for details of perquisites received and tax deducted.