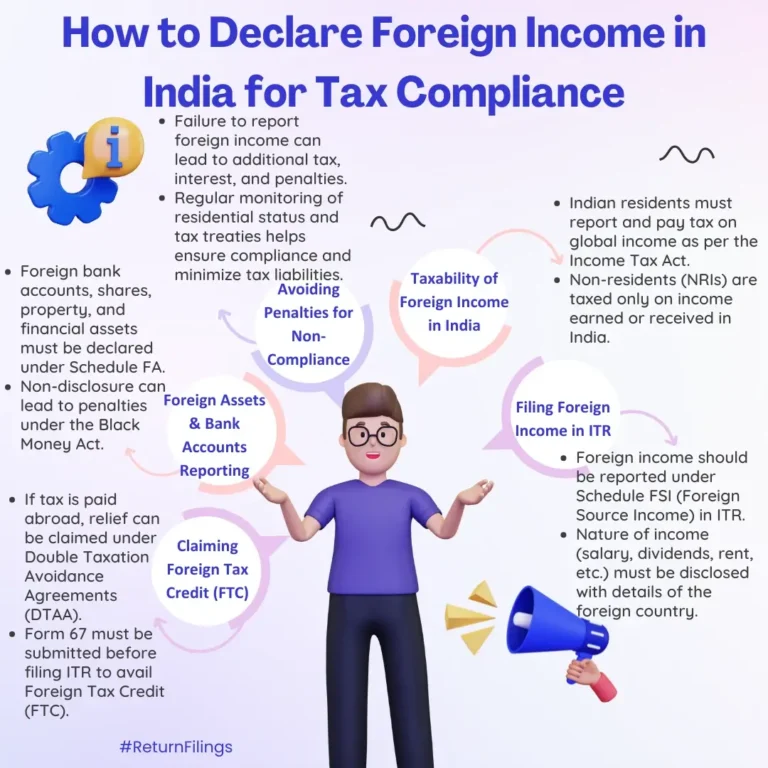

Report global income in Schedule FSI, claim FTC via Form 67, and disclose all foreign assets in Schedule FA to avoid penalties.

This infographic guides Indian residents on declaring foreign income for tax compliance. Report all global income in Schedule FSI of ITR, disclose nature and country of income, and claim FTC for taxes paid abroad using Form 67. All foreign assets must be reported in Schedule FA. Non-disclosure can lead to tax, interest, and penalties under the Black Money Act. Monitor residential status and tax treaties for compliance.