Addition of Directors in India: Types, Legal Process & Compliance Steps

1. Introduction

The Companies Act, 2013 provides for various types of directors who play a vital role in managing and governing a company. As a company grows, it may need to appoint additional directors to ensure smooth operations and compliance with legal requirements. The process of adding a director depends on the nature of directorship and statutory requirements.

2. Types of Directors as per Companies Act, 2013

The Companies Act, 2013 classifies directors into different categories based on their roles and responsibilities:

2.1 Executive Director

• Actively involved in the day-to-day management of the company.

• Can be a Whole-time Director or Managing Director.

2.2. Non-Executive Director

• Not involved in daily operations but contributes to policy decisions.

• Provides independent judgment on corporate matters.

2.3. Residential Director

• As per Section 149(3), every company must have at least one director who has stayed in India for more than 182 days in the previous financial year.

2.4. Independent Director

Ensures transparency and protects shareholder interests.

Mandatory for:

o Listed companies.

o Companies with paid-up share capital of INR 10 crore or more.

o Companies with turnover of INR 100 crore or more.

o Companies with outstanding loans/debts of INR 50 crore or more.

Must not hold more than 2% of paid-up share capital.

Maximum tenure: 5 consecutive years.

2.5. Small Shareholders Director

• Appointed by small shareholders holding at least 1/10th of the total shareholding.

• Applicable to listed companies.

2.6. Woman Director

Mandatory for:

o Companies with paid-up share capital of INR 100 crore or more.

o Companies with turnover of INR 300 crore or more.

2.7. Additional Director

• Appointed by the Board of Directors.

• Holds office until the next Annual General Meeting (AGM).

2.8. Alternate Director

• Appointed to act in place of a director who is absent for more than 3 months.

• Cannot hold office for a longer tenure than the original director.

2.9. Nominee Director

Appointed by:

o Public Financial Institutions.

o Banks or investors.

o Central Government in cases of mismanagement.

3. Compliance Process for Addition of Directors in a Company

The appointment of a new director involves several regulatory steps:

3.1 Eligibility Criteria

Before appointing a director, ensure they meet these criteria:

• Must have a valid Director Identification Number (DIN).

• Should not be disqualified under Section 164 of the Companies Act, 2013.

• Should meet the specific requirements based on the type of directorship.

3.2. Documents Required

| Document | Description | Due Date |

|---|---|---|

| DIN (Director Identification Number) | Mandatory for all directors before appointment. | Before Appointment |

| Consent in Form DIR-2 | Declaration from the individual accepting the directorship. | At the time of Appointment |

| Disclosure in Form DIR-8 | Disclosure stating that the individual is not disqualified. | Before Appointment |

| Board Resolution | Resolution passed by the Board approving the appointment. | Before Filing DIR-12 |

| Shareholder Approval (if required) | For specific types of directors (e.g., Independent Directors). | Before Appointment |

3.3. Step-by-Step Process for Appointment

a. Obtain DIN (If not already issued) through Form DIR-3.

b. Check Director’s Eligibility and Obtain Consent in Form DIR-2.

c. Hold a Board Meeting and pass a resolution for appointment.

d. File Form DIR-12 within 30 days of appointment with the MCA.

e. Update Register of Directors and Key Managerial Personnel (KMP).

f. Intimate Stock Exchanges (for listed companies).

3.4. Additional Compliance for Specific Directors

| Type of Director | Additional Compliance |

|---|---|

| Independent Director | Declaration in Form DIR-8 confirming independence. |

| Woman Director | Mandatory for applicable companies. |

| Alternate Director | Must be specified in the Articles of Association (AOA). |

| Nominee Director | Appointment must be in accordance with shareholder or lender agreements. |

4. Case Study: Importance of Proper Appointment of Directors

Scenario:

A manufacturing company needed to appoint an Independent Director to comply with regulations. However, they failed to verify the 2% shareholding restriction, leading to non-compliance and a penalty. After seeking expert consultation, the issue was resolved by appointing a qualified director who met the independence criteria.

Key Takeaways:

• Ensure eligibility and statutory compliance before appointment.

• Maintain timely filings with the MCA.

• Regularly review the composition of the board to meet changing compliance needs.

5. How We Can Help

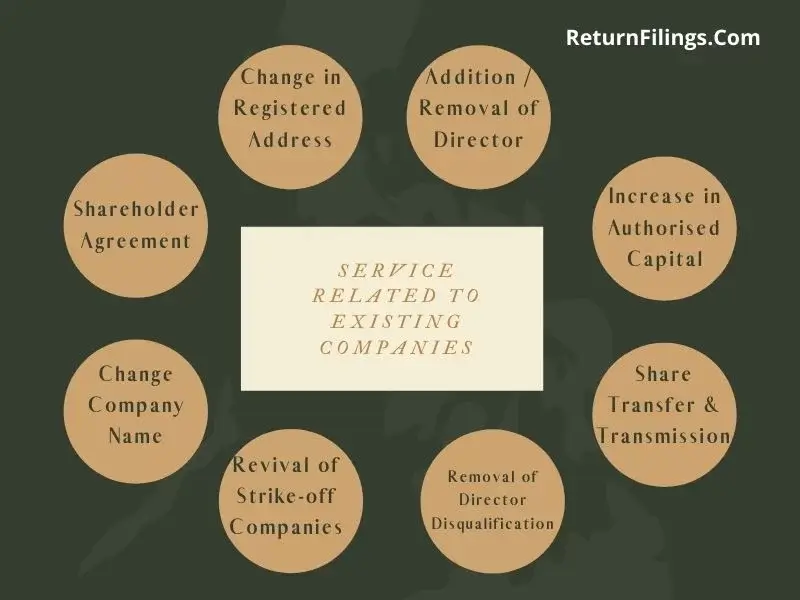

At ReturnFilings.Com, we provide end-to-end assistance for:

• Appointment of Directors.

• Compliance with MCA Regulations.

• Filing of Forms (DIR-2, DIR-8, DIR-12).

• Advisory on Corporate Governance and Board Composition.

By ensuring compliance with director appointment regulations, companies can enhance governance, meet legal obligations, and drive business success.

We ensure seamless regulatory compliance, allowing you to focus on business growth while we handle legal formalities.

For professional assistance, reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091 to ensure all statutory obligations are met on time.

frequently asked questions (faq's) related to Types of Directors and Addition of Directors in a Company

Q What are the different types of directors in a company?+

A

Indian company law recognizes various types of directors, including:

Executive Directors: Involved in day-to-day management and operations (e.g., Managing Director, CEO, Whole-time Director).

Non-Executive Directors: Not involved in daily operations, provide oversight and governance.

Independent Directors: Non-executive, independent of management and promoters, bring objectivity and protect shareholder interests.

Managing Director (MD): Executive director with substantial powers of management.

Whole-time Director (WTD): Executive director who devotes full time to the company.

Nominee Director: Appointed by a financial institution or investor to represent their interests.

Additional Director: Appointed by the board within the limits of the articles.

Alternate Director: Appointed to act in place of another director during their absence.

Resident Director: Required to reside in India for a specified period.

Woman Director: Certain companies must appoint at least one woman director.

Small Shareholder Director: Represents interests of small shareholders.

Professional Director: Appointed for their expertise in a particular field.

Government Nominee Director: Appointed by the government in certain companies.

Shadow Director/De Facto Director: Not officially appointed but whose directions are followed by the board.

Q What is the role of an Independent Director?+

A Independent directors play a crucial role in ensuring good corporate governance, protecting the interests of minority shareholders, providing objective oversight of management, and bringing independent judgment to board decisions.

Q What is the difference between an Executive Director and a Non-Executive Director?+

A Executive Directors are involved in the day-to-day management and operations of the company. Non-Executive Directors provide oversight and guidance but are not involved in daily operations.

Q How can a new director be added to a company?+

A A new director can be added by shareholders at a general meeting, by the board of directors as an additional director (within the limits of the articles), or by appointment by a financial institution or investor (nominee director).

Q What is the process for adding a new director?+

A The process generally involves passing a resolution by the board of directors (for additional directors) or shareholders (for other directors), obtaining the consent of the individual, filing the necessary forms (DIR-3, DIR-12) with the Registrar of Companies (ROC), and updating the company's register of directors.

Q What forms are required for adding a director?+

A

Key forms include:

• DIR-3: Application for allotment of DIN (if the individual doesn't already have one)

• DIR-12: Particulars of appointment/reappointment of directors and key managerial personnel

Q What documents are required for adding a director?+

A Documents typically include consent from the director to act as such, a declaration by the director that they are not disqualified, and proof of identity and address of the director.

Q When should the forms for adding a director be filed with the ROC?+

A The forms should be filed with the ROC within 30 days of the appointment.

Q What is the role of the Board of Directors in adding a director?+

A The Board identifies and selects potential directors, passes the necessary resolutions, and ensures compliance with legal requirements.

Q What are the qualifications for becoming a director?+

A The Companies Act specifies certain qualifications and disqualifications for directors. Generally, an individual must be of sound mind, not an undischarged insolvent, and not convicted of certain offenses.

Q What is the maximum number of directors a company can have?+

A As per the Companies Act, a company can have a maximum of 15 directors. This limit can be exceeded by passing a special resolution.

Q Can a company appoint a body corporate as a director?+

A Generally, no. Only individuals can be appointed as directors.

Q What is the process for removing a director?+

A A director can be removed by shareholders at a general meeting, subject to the provisions of the Companies Act.

Q How do I become a director of a company in India?+

A You need to obtain a DIN and meet the qualifications specified in the Companies Act.

Q What is the difference between a director and a key managerial personnel (KMP)?+

A Directors are members of the board, while KMPs are senior management personnel. Some individuals can be both.

Q Can a person be a director in multiple companies?+

A Yes, but there are limits on the number of companies in which a person can serve as a director.

Q What are the responsibilities of a company director?+

A Directors are responsible for overseeing the company's management, acting in good faith, and complying with the law.

Q How do I resign from the position of a director?+

A You need to submit a resignation letter to the company and follow the procedure laid down in the articles of association.

Q What is the process for appointing an additional director?+

A The board can appoint an additional director within the limits of the articles, subject to shareholder approval at the next general meeting.

Q What is the role of the Nomination and Remuneration Committee?+

A This committee recommends the appointment and remuneration of directors and key managerial personnel.

Q How can I find information about the directors of a company?+

A This information is publicly available on the MCA website.

Q What are the legal implications of being a company director?+

A Directors have legal responsibilities and can be held liable for certain actions of the company.

Q Where can I find the latest MCA notifications and circulars related to directors?+

A The MCA website is the official source for notifications and circulars.

- For further reading, explore the following topics:

- 🚚 How to Generate GST E-Way Bill in India: Step-by-Step Process & Compliance Guide

- 💸 GST Exemption Rules in India: Who Qualifies, How to Claim & Required Documentation

- 📈 Authorized Capital Increase in India: Legal Requirements and MCA Filing Process

- 💼 Tax Deductions & Exemptions in India : Essential Information for Taxpayers