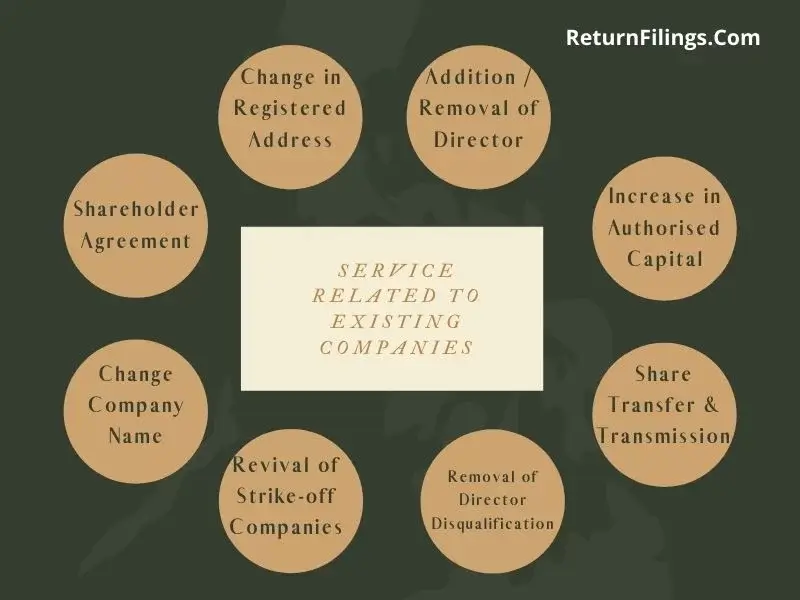

What to do for Revival of Struck-Off Companies in India: Legal Steps, Clarity & Compliance Guide

1. Introduction

Companies in India may be struck off by the Registrar of Companies (RoC) for various reasons, including non-commencement of business or failure to comply with statutory filings. However, struck-off companies have the option to seek revival through the National Company Law Tribunal (NCLT). This guide provides a detailed overview of the revival of struck-off companies, applicable laws, and necessary documentation.

2. Difference Between Striking Off and Winding Up

• Striking Off: The company is removed from the official records of RoC due to non-compliance or inactivity. Revival is possible within three years.

• Winding Up: A company is permanently closed, either voluntarily or through a legal process, with no option for revival.

3. Reasons for Striking Off a Company

A company may be struck off if:

• It fails to commence business within one year of incorporation.

• It does not conduct any business activities for two consecutive financial years.

• It does not file annual returns and financial statements for three consecutive financial years.

4. Legal Provisions for Revival of struck-off companies

• For revival of struck-off companies as per Companies Act, 2013, Section 252(1): Any aggrieved party (shareholders, directors, creditors, or workmen) can apply for revival within three years from the date of striking off.

• NCLT has the authority to restore a company’s name to the official register and allow it to resume operations.

5. Who Can Apply for Revival OF STRuck-off companies?

• Directors or Shareholders: Those representing the company can apply.

• Creditors: If a creditor has an unsettled claim, they can file for revival.

• Workmen: Employees with pending dues can also initiate the process.

6. Procedure for Revival of Struck-Off Companies

6.1 Filing an Application with NCLT

• A writ petition must be filed before NCLT.

• The petition must contain:

o Company Incorporation Certificate

o Memorandum & Articles of Association

o Bank statements since incorporation

o Income tax returns and financial statements

o Any proof of pending litigation or business transactions

o Letter from the bank if the account is frozen

6.2 Serving Notice to RoC

• A copy of the application must be sent to the RoC and other concerned parties as directed by the tribunal.

6.3 Tribunal Hearing

• The applicant must attend the hearing.

• NCLT examines reasons for striking off and the justification for revival.

• Any objections raised by RoC or third parties are addressed.

6.4 Passing of Tribunal Order

• If satisfied, NCLT passes an order for revival.

• The order directs RoC to restore the company’s name to the register.

6.5 Filing Order with RoC for revival of struck-off companies

• The order must be filed with RoC within 30 days.

• RoC publishes the order in the Official Gazette.

7. Post-Revival Compliance Requirements

Once revived, the company must:

• File all pending annual returns and financial statements.

• Pay any penalties for non-compliance.

• Ensure timely statutory compliance to avoid future disqualification.

8. Case Study Example

Example: A private limited company was struck off due to failure to file annual returns for three years. The directors applied to NCLT for revival, providing proof of ongoing business transactions and existing assets. NCLT approved the revival, subject to payment of penalties and submission of all pending filings.

By following the outlined steps and ensuring compliance, businesses can successfully pursue for revival of struck-off companies and resume operations legally. For expert assistance, reach out to us on email: info@returnfilings.com or on whatsapp: https://wa.me/919910123091 to ensure all statutory obligations are met on time.

frequently asked questions (faq's) related to Revival of Struck Off Companies

Q What does it mean when a company is "struck off"?+

A When a company is "struck off" by the Registrar of Companies (ROC), its name is removed from the Register of Companies and it ceases to exist as a legal entity. This is different from winding up, as the company cannot continue operations until its name is restored on the register.

Q Why are companies struck off?+

A Companies are typically struck off for reasons such as:

• Failure to file financial statements or annual returns for a continuous period (usually three years)

• Failure to commence business within one year of incorporation

• Not carrying on any business or operation for two consecutive financial years without applying for dormant status

• Subscribers not paying the subscription amount and not filing the declaration within 180 days of incorporation

• Failure to obtain a commencement of business certificate within one year of incorporation

• Directors not declaring that all subscribers have paid for their shares within 180 days

Q What is the difference between "struck off" and "wound up"?+

A "Struck off" is a summary procedure for defunct companies, involving removal of the company's name from the register. "Wound up" is a formal legal process involving liquidation of assets and distribution to creditors and shareholders.

Q Can a struck-off company be revived?+

A Yes, a struck-off company can be revived by making an application to the National Company Law Tribunal (NCLT).

Q What is the process for reviving a struck-off company?+

A The process generally involves:

• Filing an application with the NCLT within three years from the date of the strike-off order

• Demonstrating sufficient cause for revival

• Providing evidence of the company's operations or reasons for inactivity

• Submitting required documents and paying prescribed fees

• Appearing before the NCLT for hearings

• Complying with the NCLT's order for revival (if granted)

Q What documents are required for the revival application?+

A Documents typically include:

• Application to the NCLT

• Copy of the strike-off order

• Financial statements and annual returns (if applicable)

• Evidence of business operations or reasons for inactivity

• Affidavits from directors

• Any other documents as required by the NCLT

Q What is the time limit for applying for revival?+

A The application for revival must be filed with the NCLT within three years from the date of the strike-off order.

Q What happens after the NCLT approves the revival?+

A If the NCLT approves the revival, the company's name is restored to the Register of Companies and it resumes its legal existence. The company must then file all pending annual returns and other compliances.

Q What are the grounds for the NCLT to allow the revival of a struck-off company?+

A The NCLT considers factors such as whether the company was genuinely carrying on business or had reasonable cause for inactivity, any outstanding liabilities, whether revival is in the interest of justice and equity, and compliance with legal requirements.

Q What if the company was struck off due to non-filing of returns?+

A If the company was struck off due to non-filing of returns, filing all pending returns and paying any applicable penalties is usually a prerequisite for revival.

Q What are the fees for reviving a struck-off company?+

A The fees are prescribed by the NCLT and are subject to change.

Q How long does the revival process take?+

A The revival process can take several months, depending on the NCLT's workload and the complexity of the case.

Q Can a company be revived after three years of being struck off?+

A Generally, no. The application for revival must be made within three years of the strike-off order. However, the NCLT has discretionary powers and in exceptional circumstances, might consider applications beyond the three-year limit. It is best to consult with a legal professional.

Q What happens to the company's assets and liabilities after revival?+

A Upon revival, the company's assets and liabilities are restored, and it resumes its legal existence as if it had not been struck off.

Q How do I know if a company is struck off?+

A You can check the status of a company on the MCA website.

Q What is the procedure for winding up a company?+

A Winding up is a more formal process involving liquidation of assets and distribution to stakeholders.

Q Can a struck-off company be sued?+

A Generally, no, as it has ceased to exist legally. However, liabilities incurred before the strike-off may still be pursued against directors or promoters in certain cases.

Q What happens to the bank accounts of a struck-off company?+

A The bank accounts are usually frozen.

Q How do I restore the bank accounts of a revived company?+

A You will need to provide the bank with the NCLT order for revival.

Q What are the implications of a company being struck off for its directors?+

A Directors may face certain disqualifications.

Q How can I avoid my company being struck off?+

A Ensure timely filing of financial statements and annual returns, and comply with all legal requirements.

Q What is the role of a professional in the revival process?+

A A professional can assist with the preparation and filing of the necessary applications and documents for revival.

Q What are the common challenges faced in reviving a struck-off company?+

A Challenges can include proving sufficient cause for revival, dealing with legal complexities, and managing the NCLT process.

- For further reading, explore the following topics:

- 🔒 How to Close a Private Limited Company in India – Step-by-Step Guide

- 📊 Expert GST Advisory in India: Full-Service Scope, Strategic Benefits & Case-Based Insights

- 🛠️ Complete Guide to Project Office Registration in India: Requirements, Steps & Compliance

- 📜 GST Amnesty Scheme India: Latest Updates, Benefits & Compliance Guide for Taxpayers