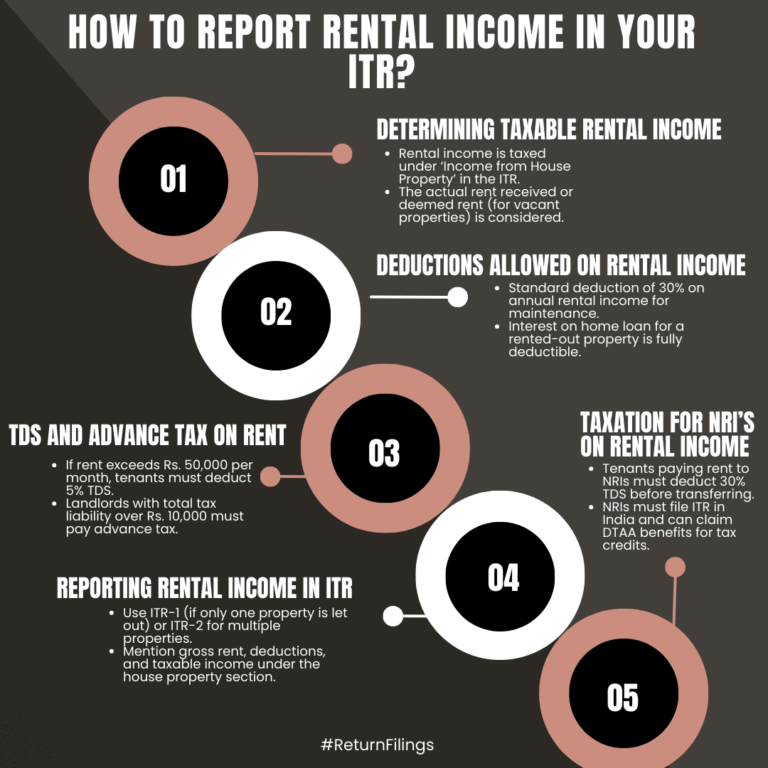

Report rental income under ‘Income from House Property’; claim 30% deduction and interest on loan; NRIs face 30% TDS.

This infographic explains how to report rental income in your ITR. Rental income is taxed under ‘Income from House Property’ based on actual or deemed rent. Claim a standard 30% deduction for maintenance and full deduction for home loan interest. Tenants must deduct 5% TDS if rent exceeds ₹50,000/month. NRIs receive rent after 30% TDS. Use ITR-1 for one property or ITR-2 for multiple. Declare all details for compliance and possible DTAA benefits for NRIs.