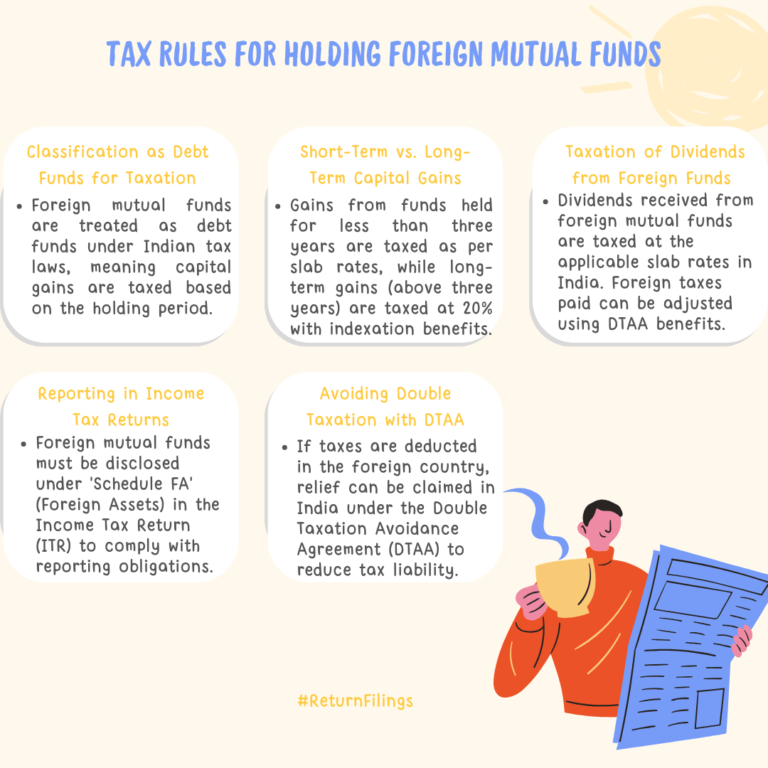

Foreign mutual funds are taxed as debt funds; report in Schedule FA and claim DTAA relief for foreign taxes paid.

This infographic explains tax rules for Indian residents holding foreign mutual funds. Gains from funds held less than 3 years are taxed as per slab rates; long-term gains (over 3 years) are taxed at 20% with indexation. Dividends are taxed at slab rates, and foreign taxes paid can be adjusted using DTAA. Disclose all holdings in Schedule FA of your ITR.